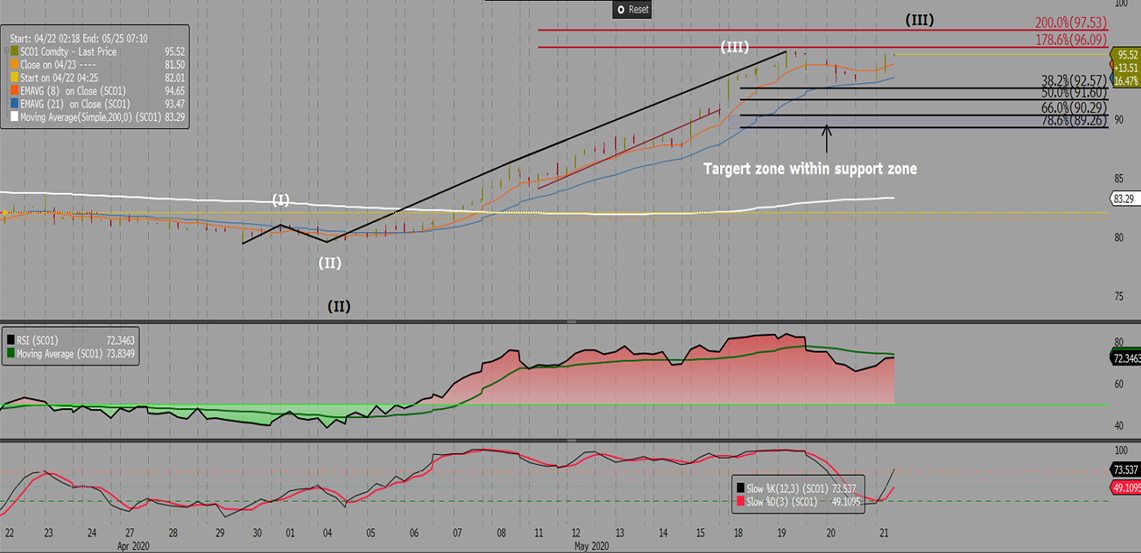

Iron ore futures recovered from yesterday’s blip to trade above $95 as investors become increasingly concerned over the coronavirus crisis in Brazil. Brazil’s iron ore shipments had their slowest start to a year in the last five years. Brazilian miner Vale downgraded its production guidance early in the year, Morgan Financials Ltd noted that more …

Continue reading “Iron ore blips back on supply fears, stimulus hopes”