Monthly archives: May 2020

Oil Rally Stalls With Fed Warning Countering Production Cuts

Oil steadied after a four-day gain as investors weighed signs the market is rebalancing against what’s still a precarious economic outlook. Futures in New York for July delivery edged above $32 a barrel after the June contract closed at a 10-week high as it expired. Federal Reserve Chairman Jerome Powell warned Americans could start losing …

Continue reading “Oil Rally Stalls With Fed Warning Countering Production Cuts”

Dalian Corn Futures Drop to Lowest Level Since March

Corn futures in Dalian fell to the lowest intraday level in almost two months amid speculation over the possibility of more import quotas and as the market awaits a delayed auction from state reserves. China is likely to utilize its entire low-tariff corn import quota of 7.2 million tons this year due to attractive import …

Continue reading “Dalian Corn Futures Drop to Lowest Level Since March”

Zinc Falls From 3-Month High on Rising Supply

Zinc retreated from its highest close since February as pandemic-driven supply disruptions ease. Zinc’s backwardation on the London Metal Exchange narrowed Tuesday in a sign that supply is set to recover. Mines are gradually resuming production as virus restrictions ease and Chinese smelters are boosting runs. Investors will focus on China’s policy-setting National People’s Congress …

Continue reading “Zinc Falls From 3-Month High on Rising Supply”

China May Tighten Australian Coal Imports Amid Tensions

China may tighten Australian coal imports amid recent tensions between the two countries, according to a daily note from China Coal Market, which is affiliated with China Coal Transport and Distribution Association. * If the curbs are put in place, Australian coal prices will be hit, said the note * NOTE: China targeted Australian coal …

Continue reading “China May Tighten Australian Coal Imports Amid Tensions”

Iron Ore Gains as Mills Shell Out Premium in Tight Market

Iron ore is on an extraordinary rally this month as growing optimism about China stimulus fuels a market already concerned about one of its biggest suppliers. The futures contract in China has surged more than 16% in May alone as stronger-than-expected demand combined with Brazil’s emergence as the world’s new coronavirus hotspot, spurring concerns that …

Continue reading “Iron Ore Gains as Mills Shell Out Premium in Tight Market”

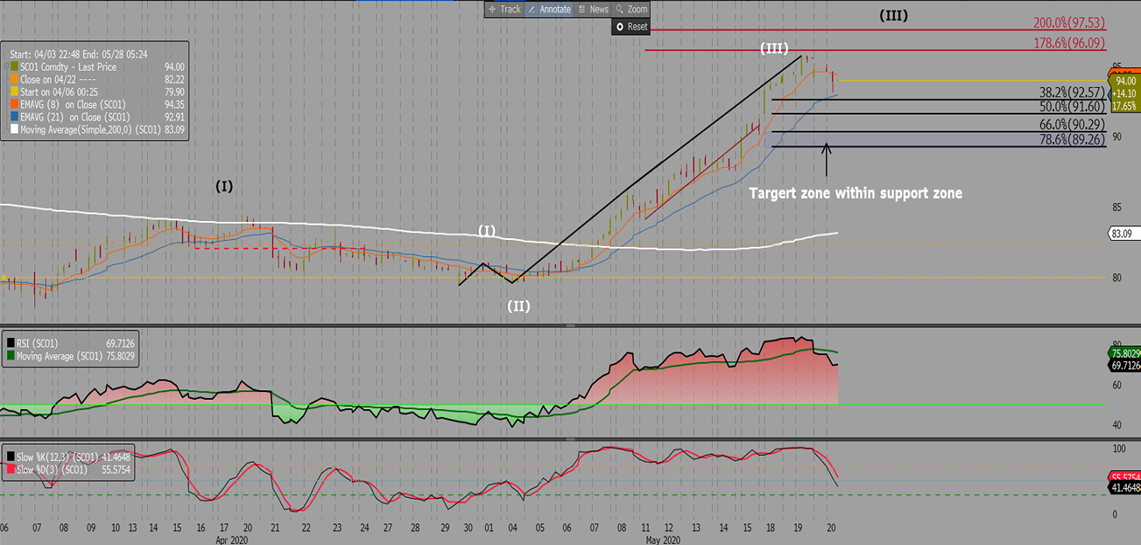

FIS Technical – Copper Rolling 3 Month

China Is Now India’s Biggest Iron Ore Buyer, And Wants to Import More

May 19 — China was India’s largest purchase of iron ore in the fiscal year ended March 31, and the buyer reportedly has plans to import even more ore from the sub-continental Asian nation. China bought 30.8 million tons of iron ore from India during the period, two and a half times more than the …

Continue reading “China Is Now India’s Biggest Iron Ore Buyer, And Wants to Import More”