*Crude Holds Above $42* Oil this morning is holding onto recent gains, staying above the $42 mark on Brent. Brent crude’s prompt spread was in backwardation for a third day, a bullish market structure that indicates tightening supply. It flipped from contango on Thursday for the first time since March. Meanwhile in the US oil …

Monthly archives: June 2020

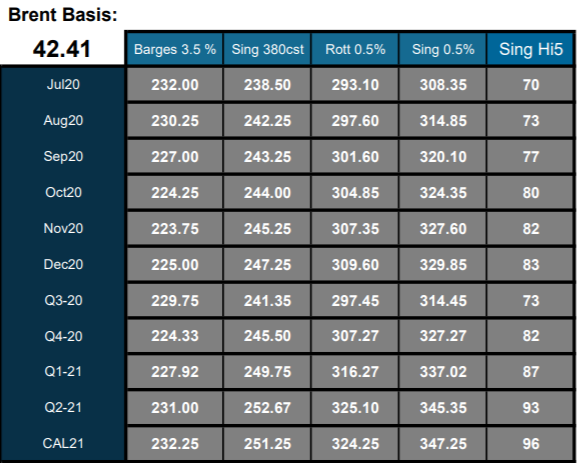

FIS Fuel Oil Morning Report 22/06/2020

Brent crude fell 10 cents, or 0.2%, to $42.04 a barrel by 0655 GMT, while U.S. crude was at $39.72 a barrel, down 11 cents, or 0.3%. Both contracts rose about 9% last week and Brent crude futures have flipped into backwardation, so that oil for immediate delivery costs more than that to be provided …

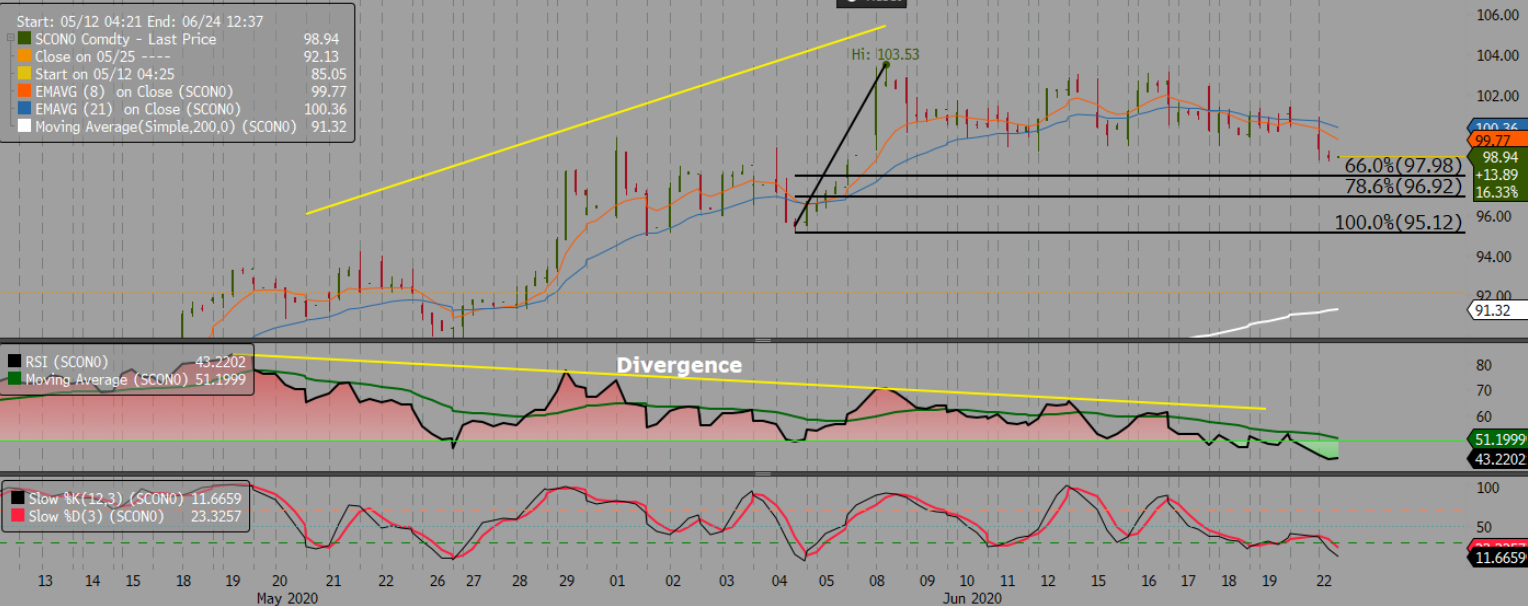

Iron Ore Offshore July 20 Morning Technical Comment – 240 Min Chart

Iron Ore DCE September Daily Technical Review Jun 22nd(Daily Chart from Mar 11th to Jun 22nd)

Verdict – Short-term neutral to bearish. DCE iron ore correct in the morning session and consolidate arround 753.0 level during the afternoon. The ferrous sector position evaporated from previous week. A breakdown on 746.5 level potentially drive market to mid-run bearish. DCE iron ore sep contract technical signals including MACD, slow stocahstic KD and CCI …

FIS Daily Physical Review Jun 22nd

Iron Ore and Steel Market Updates – The low grade fines and discounted fines are becoming higher versus major brands iron ores, indciated steel mills are thinking of controling production cost. – China Jan – May cement production at 769 million tonnes, down 8.2% y-o-y. However may cement production at 249 million tonnes, up 8.6% y-o-y, …

Fuel Oil Daily Evening Report

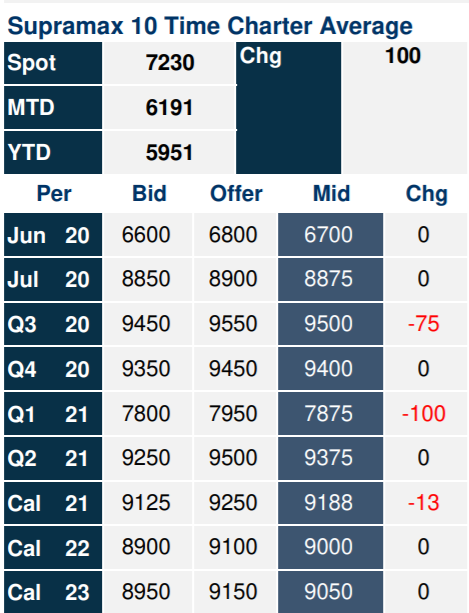

Supramax & Handysize FFA Daily Report

Capesize & Panamax FFA Daily Report

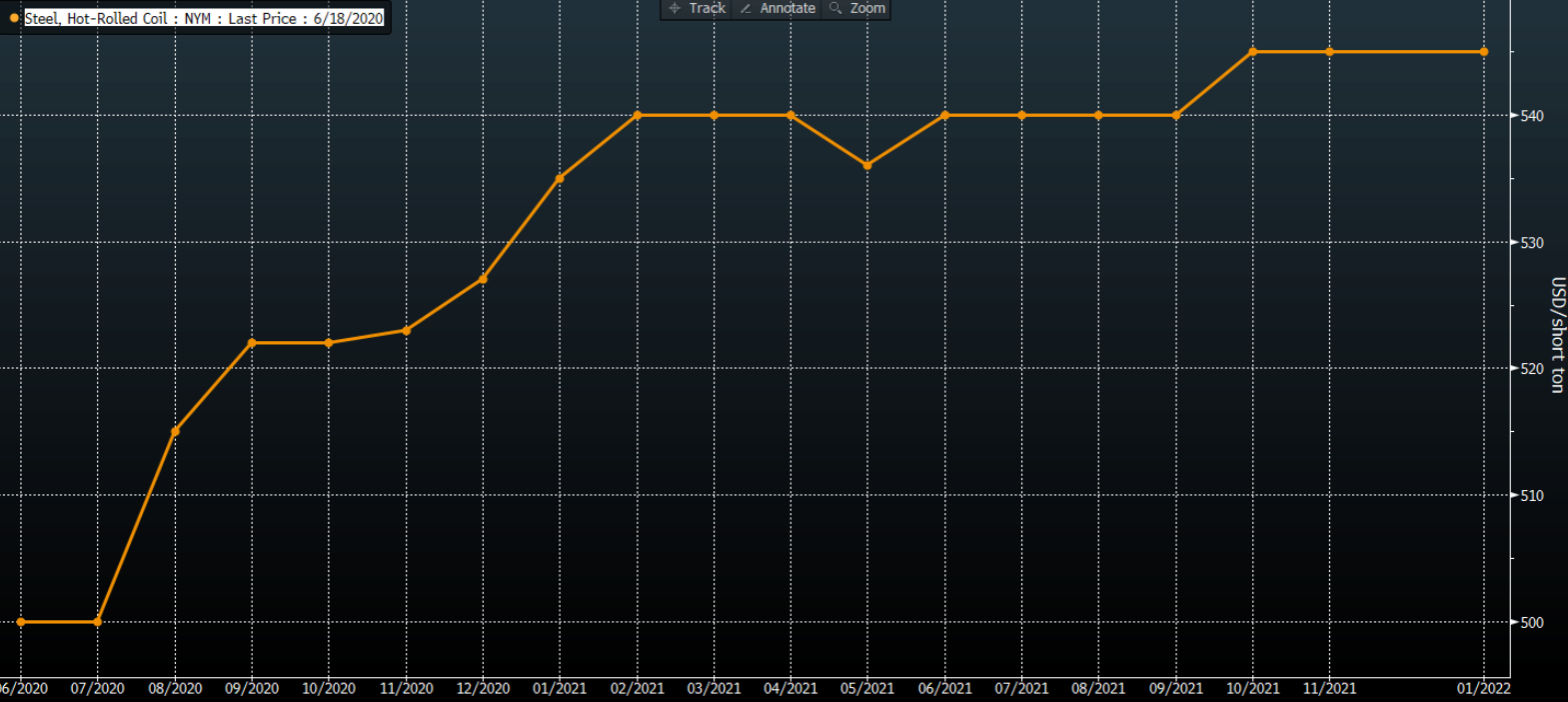

Positive Outlook from U.S. Steelmakers

A traumatic start to the year for U.S. steel makers may now be behind them after some of the largest producers offered positive outlooks for the rest of the year. Non-residential construction in the U.S has remained resilient compared to the consumer sector in recent months. With it looking increasingly like the worst of …

Iron ore holds at $100 as Brazil supply fears ease

Iron ore futures held at around $100 on Friday as supply concerns eased. Latest data showed that Brazil’s iron ore exports increased by 1.4 million tonnes during the first nine days of Jun to 1.64 million tonnes per day. Meanwhile, Vale is gradually resuming operations at its Itabira complex after receiving the green …

Continue reading “Iron ore holds at $100 as Brazil supply fears ease”