Monthly archives: June 2020

Brent August 20 Morning Technical Comment – 240 Min

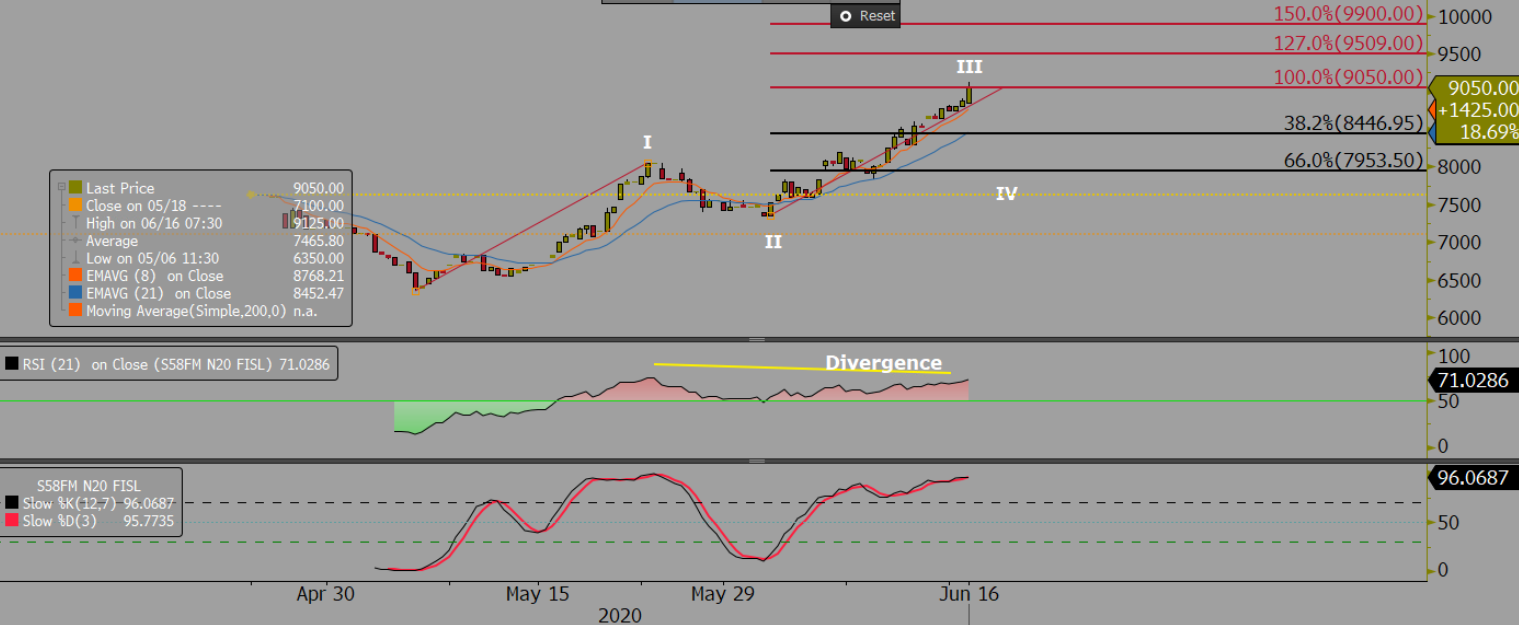

Iron Ore DCE September Daily Technical Review Jun 17th(Hourly Chart from Apr 20th to Jun 17th)

Verdict – Short-term neutral. DCE iron ore consolidate for few days and correct during today. The highs are becoming lower at 798.0,788.0,786.5. The lows are becoming higher 733.5,756.5,764.0. In short-run, iron ore traded in a triangle and narrowing in the consolidating range. From hourly chart, MACD widened below 0 axis after dead cross. Slow stochastic …

FIS Daily Physical Review Jun 17th

Iron Ore and Steel Market Updates – Jun 8 -14th Australia and Brazil iron ore delivery at 25.14 million tonnes, down 4.16 million tonnes w-o-w. Australia delivery at 18.41 million tonnes, down 3.27 million tonnes. Brazil delivery 6.73 million tonnes, down 885,000 tonnes. – MySteel surveyed Australia and Brazil iron ore port overhaul(Jun 15 – …

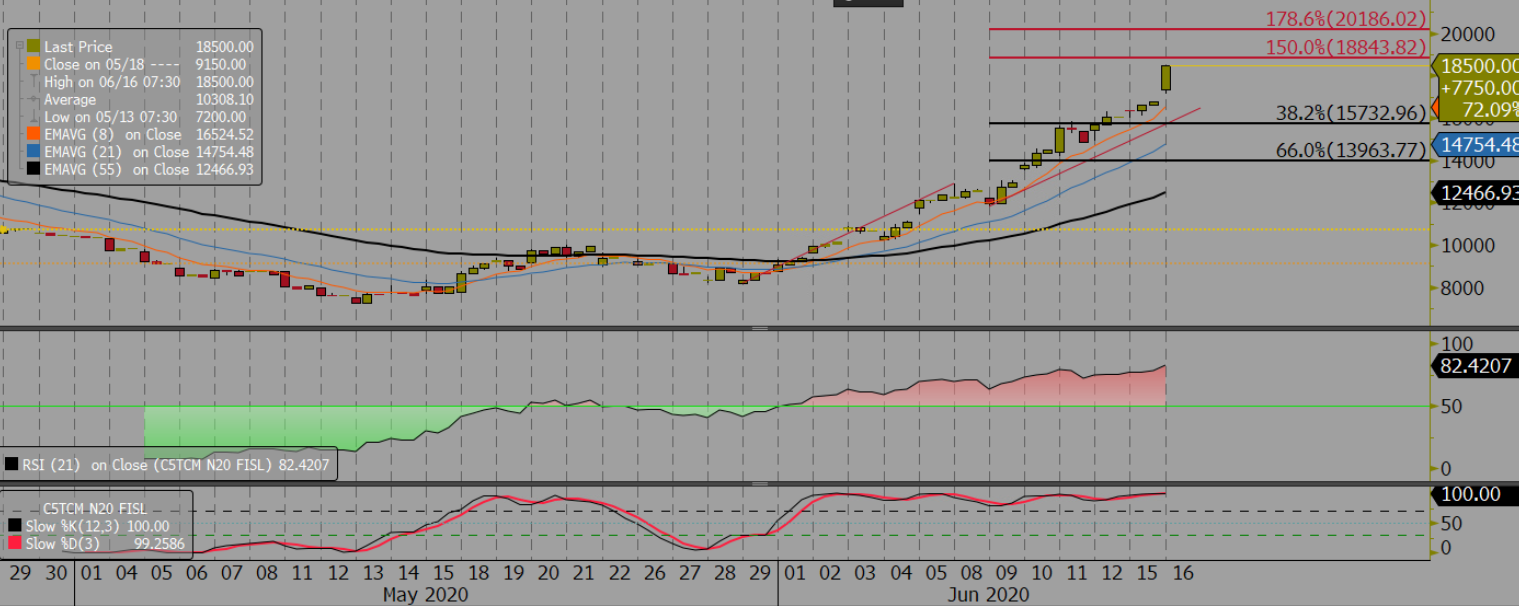

FIS Capesize Technical Report

FIS Capesize Technical Report On the last report we noted that if the RSI went through the 62—64 resistance level the index had a greater chance of going on a run. This has been the case with the index moving 100% higher. To view the full report please click on the link

Supramax July 20 Morning Technical Comment – 240 Min

DCE rises on higher steel output

Chinese futures rose higher on Tuesday, buoyed by higher steel production in China from strong domestic construction demand. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, which increased by 1.03% day-on-day to RMB 781 per tonne on Tuesday. However, the steel rebar contract on the Shanghai Futures Exchange, …

Oil Through the Looking Glass 16/6/20

*Covid-19 vs Supply Cuts* The tussle between bearish and bullish news continues for crude. Coronavirus cases rose to more than 8 million worldwide yesterday, with infections surging in Latin America, while the United States and China are dealing with fresh outbreaks. On the supply side the UAE energy minister said that he had confidence OPEC+ …

Capesize July 20 Morning Technical Comment – 240 Min

Capesize moves up despite slight cooldown

Capesize rates moved up again on bullish market sentiments for both the Pacific and Atlantic basins. The Capesize 5 time charter average rose by $887 to $13,297 on Monday, reaching new highs for the prompt, while testing the recent highs on Q4 and Cal 21. The Baltic Dry Index also increased by 5.42% to 973 …

Continue reading “Capesize moves up despite slight cooldown”