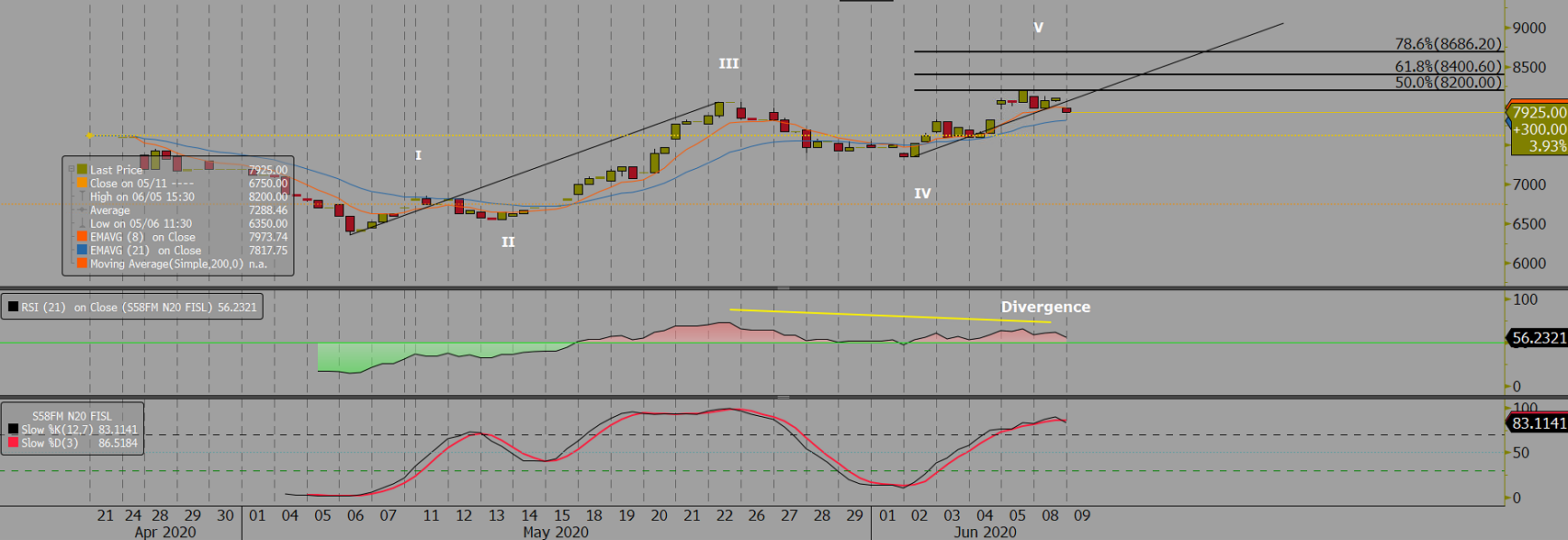

Capesize rates continued the bullish run over Brazilian supply concerns, while high construction activities in China support iron ore demand. As such, the Capesize 5 time charter average jumped by $438 day-on-day to $7,745 on Monday, after more European players entered the market and pushed up rates. The Baltic Dry Index (BDI) followed the rally …

Continue reading “Capesize rides along with the iron ore bull run”