FIS Panamax Technical Report To view the full report please click on the link

Monthly archives: June 2020

Iron ore breaks $100 as Vale shuts in production capacity

Iron ore futures surged above $100 on Monday after part of Vale’s Brazilian operations were ordered to be shut down due to the Coronavirus. Prosecutors had alleged that workers were at risk at the mine complex of Itabira in the state of Minas Gerais after 188 of them were tested positive. The latest development …

Continue reading “Iron ore breaks $100 as Vale shuts in production capacity”

Oil Through the Looking Glass 8/6/20

Cuts and Imports It must be music to the ears of all oil producers: the oil guzzling Chinese mainland has increased their crude imports to all-time highs. Low prices have drawn Chinese buyers to boost imports, with purchases rising to 11.3 million bpd in May. If you throw in the news of the one-month extension …

Brent August 20 Morning Technical Comment – 240 Min

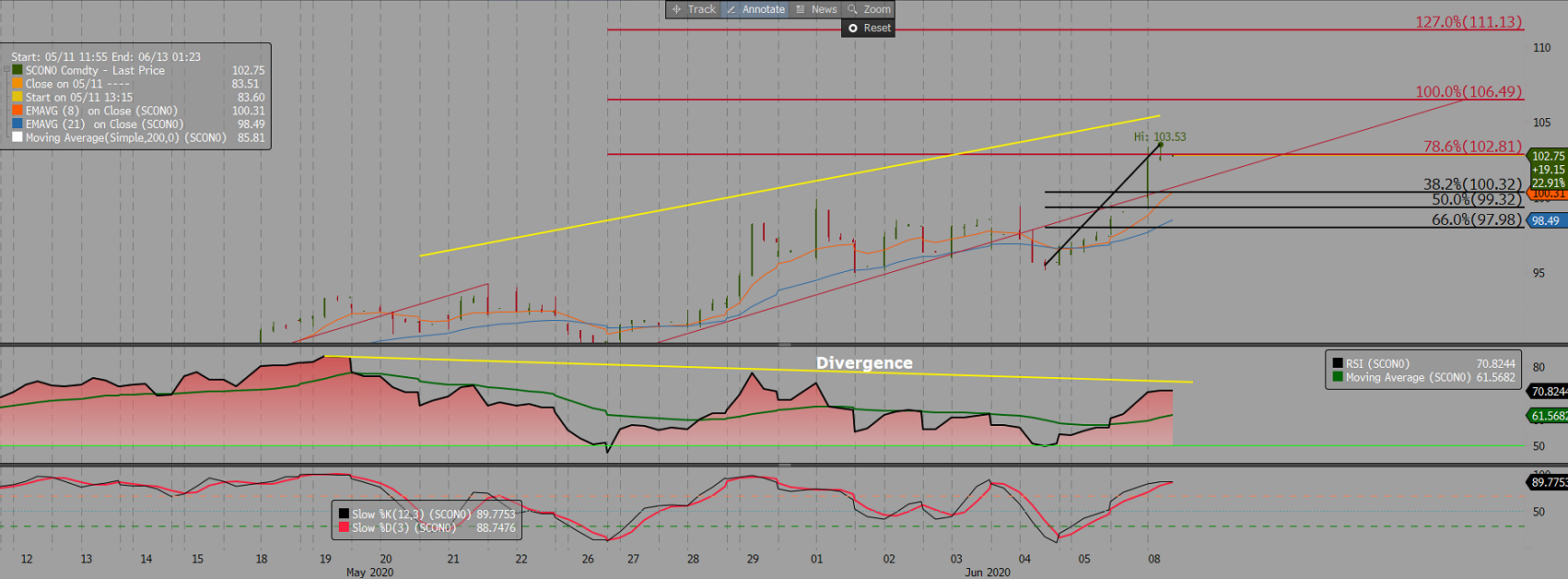

DCE rises over Vale’s supply woe

Chinese futures rose further over supply concerns as Vale was ordered to suspend its Itabira mine amid coronavirus pandemic. Thus, the most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, jumped up by 5.53% day-on-day to RMB 783 per tonne on Monday. However, the steel rebar contract on the Shanghai …

Soy rises on China hopes but long term doubts remain

US domestic Soy prices have produced their highest close in nine weeks and their highest weekly percentage increase since March 27th. The price increase is on the back of continued purchases of U.S. agricultural products by China. Committed to over 50 billion tonnes of purchases, China has come under fire for sourcing Soy …

Continue reading “Soy rises on China hopes but long term doubts remain”

Panamax July 20 Morning Technical Comment – 240 Min

Capesize July 20 Morning Technical Comment – 240 Min

Capesize rates continue the good run on firmer iron ore demand

Capesize rates buoyed on good physical fixture with healthy shipping demand out of both basins. Thus, the Capesize 5 time charter average spiked sharply by $1,130 day-on-day to $7,307 on Friday, after a solid gain that lifted the curve to weeks highs. Following the Capesize rally, the Baltic Dry Index (BDI) also surged further to …

Continue reading “Capesize rates continue the good run on firmer iron ore demand”