Monthly archives: June 2020

Capesize & Panamax FFA Daily Report

Capesize gains despite China’s holidays

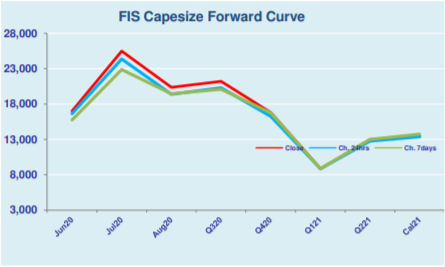

Capesize rates saw little gains as Chinese trade participants were away on holidays, leaving the market with thin activities. Despite the muted activities, the Capesize 5 time charter average still managed to rise by $246 day-on-day to $29,641 on Friday. The Baltic Dry Index (BDI) kept its upward momentum to 1,749 points on Jun 26, …

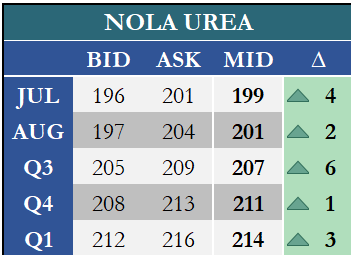

Fertilizer Financial Markets Commentary/Curves

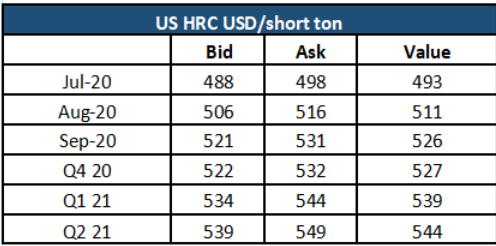

Steel & Scrap 29-06-20

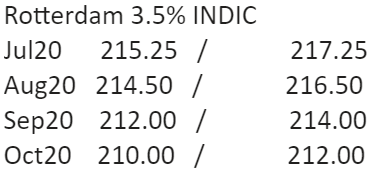

FIS Fuel Oil Morning Report 29/06/2020

Good morning. Oil is lower today with the virus weighing on demand again. Cases rose in the United States and other places, leading some countries to resume partial lockdowns that could hurt fuel demand. Brent dropped 81 cents, or 2%, to $40.21 a barrel by 0653 GMT, while U.S. was at $37.74, down 75 cents, or …

FIS Technical – DCE Iron Ore Sep 20

DCE drops despite return of Chinese participants from holidays

Chinese futures slipped downward despite the return of Chinese participants after a long holiday. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, went down by RMB 29 or 3.79% day-on-day at RMB 736 per tonne on Monday. The steel rebar contract on the Shanghai Futures Exchange followed suite …

Continue reading “DCE drops despite return of Chinese participants from holidays”

Brent August 20 Morning Technical Comment – 240 Min

Iron Ore DCE September Daily Technical Review Jun 29th

Verdict – Short-term bearish. DCE iron ore broke down 746.5, the neckline of previous multiple tops from June 5th. If a further breakdown on 733.0, iron ore potentially entered a bearish market and targeting 685.5. From hourly chart, Iron ore created dead cross during this morning with massive volume. Slow stochastic KD widened after a …

Continue reading “Iron Ore DCE September Daily Technical Review Jun 29th”