Monthly archives: July 2020

Oil Through the Looking Glass 23/7/20

*Unexpected Rise in US Stocks Both US oil and distillate stocks rose unexpectedly and fuel demand slipped according to data released by the EIA yesterday. Crude stocks rose 4.9 million bbls last week to a total of 536.6 million bbls; this was despite an analysts’ expectation of a draw of 2.1 million. Distillate stockpiles rose …

Freight Intraday Morning Technical

Capesize rate slides toward $20,000 level on supply glut

Capesize rates continued its downward slide toward the $20,000 level due to the supply glut in the market. The Capesize 5 time charter average fell by $2,515 day-on-day to $20,120 on Wednesday, as trading came to stalemate and slowed in final two hours before the afternoon closing. The Baltic Dry Index (BDI) then slipped by …

Continue reading “Capesize rate slides toward $20,000 level on supply glut”

Steel & Scrap Morning Report

DCE corrects on narrowing steel margins

Iron ore future saw a slight correction and retreated from the recent rally due to narrowing steel margins. Thus, the most-traded iron ore for September delivery on China’s Dalian Commodity Exchange slipped slightly by 0.29% or RMB 2.50 to RMB 845.50 per tonne on Thursday. On the contrary, the steel rebar contract on the Shanghai …

Oil and Ore Intraday Morning Technical

Iron Ore DCE September Daily Technical Review Jul 23rd

Verdict – Short-term consolidation. Iron ore closed slight higher than last closing however created lower highs and lows, indicating exhausting in current trading days. The support observed from hourly chart at 835.0. The resistance is a descending line connecting 861.5, 854.5 and 849.5. However be aware of the divergence of last minute market between rebar(up) …

Continue reading “Iron Ore DCE September Daily Technical Review Jul 23rd”

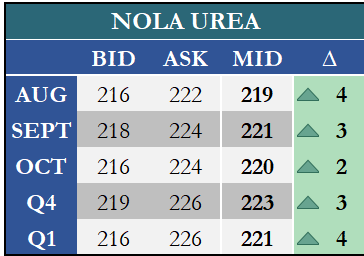

Fertilizer Financial Markets Commentary/Curves

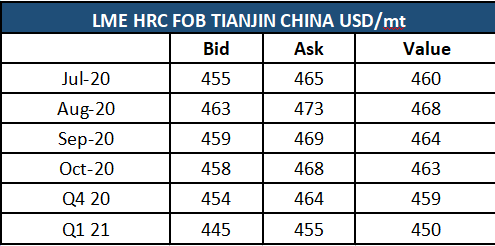

Daily Ferrous Physical Review Jul 23rd

Ferrous Market Updates – MySteel Rebar Inventory: Rebar production 3.83 million tonnes, down 0.03% w-o-w. Mills inventory 3.43 million tonnes, up 3.63% w-o-w. Circulation inventory 8.55 million tonnes, up 1.57% w-o-w. – CISA: mid-July major mills crude steel daily production 2.14 million tonnes, up 0.36% from early July. Pig iron 1.91 million tonnes, down 0.42% …