Monthly archives: July 2020

Oil Through the Looking Glass 22/7/20

*Narrowing Fuel Oil Contango The dropping contango structure of the fuel oil curve may encourage traders to offload stored supplies of fuel to protect against falling future margins. The front Aug/Sep spread was marked at flat this morning, as the VLSFO market followed the lead of the HSFO in moving from contango back into backwardation. The …

Capesize rates drag down by high tonnage list

Capesize rates spiraled downward due to high tonnage list that resulted weakness in the Pacific market. As such, the Capesize 5 time charter average dropped further by $1,834 day-on-day to $22,635 on Tuesday, after a steep sell off down the curve during late afternoon session. Following the decline, the Baltic Dry Index (BDI) slipped by …

Continue reading “Capesize rates drag down by high tonnage list”

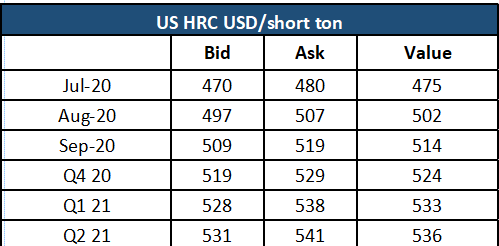

Steel & Scrap Morning Report

Iron Ore Offshore Aug 20 Morning Technical Comment – 240 Min Chart

DCE gains on better H2 outlook

Iron ore future rose for the second consecutive day on better market outlook on anticipation of improved steel demand after rainy season in China. The most-traded iron ore for September delivery on China’s Dalian Commodity Exchange continued the upward trend with gains of 1.14% or RMB 9.50 day-on-day to RMB 841.50 a tonne on Wednesday. …

FIS Fuel Oil Morning Report 22/07/2020

Brent futures tumbled 35 cents, or 0.8%, to $43.97 a barrel by 5:41 am GMT, and WTI futures plunged 39 cents, or 0.9%, to $41.53. Front-month September ICE Brent futures briefly touched a four-month high above $44.80/b in the US trading sessions as investor optimism was buoyed by promising results from multiple COVID-19 vaccine trials …

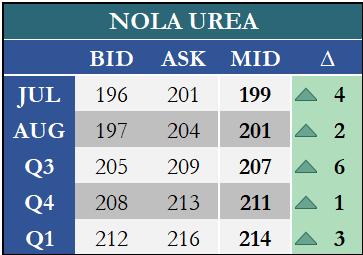

Ferts in Focus 22/07/20

*Indian tender prices disappoint Urea markets once again revolved around news out of India this past week, with the closing of their latest urea purchasing tender on Friday. As last time, the most competitive offers into the tender were below market expectations. However, rather than accept prices this time round, most participants in the tender have …

Tanker News Update

*Transatlantic Bulls The past couple of days have seen a large jump in transatlantic routes worldscale values. The main routes that carry gasoline on MR vessels are; TC2 travelling from ARA to NY and the back-haul route, TC14 from Houston to ARA. TC2 rates in previous weeks had seen lows of WS70, however the start …