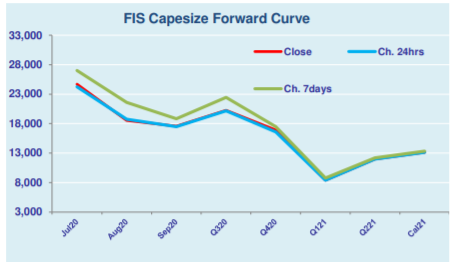

Capesize rates came under correction again, perhaps fulfilling market expectation of a week for correction due to shipping supply glut. The Capesize 5 time charter average then fell further by $1,175 day-on-day to $24,387 by mid-July, 15 July 2020, despite an influx buyers entered at the afternoon session. Following the decline, the Baltic Dry Index …

Continue reading “Capesize rates venture into a week of correction”