Ferrous Market Updates – Both port trades and seaborne trades are traded lower yesterday. Some physical traders are reluctant to accept the high price. From the other side, Australia has boost volume during the last month of the fiscal year. – MySteel Rebar Inventory: Rebar production 3.89 million tonnes, down 2.99% w-o-w. Mills inventory 3.41 …

Monthly archives: July 2020

London Iron Ore Market Report

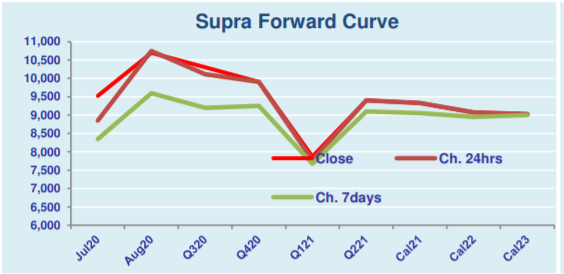

Supramax & Handysize FFA Daily Report

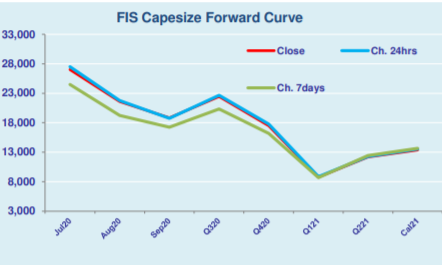

Capesize & Panamax FFA Daily Report

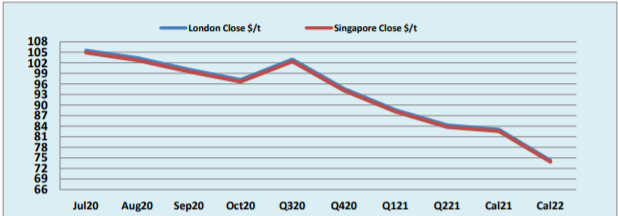

FIS LONDON COKING COAL MARKET REPORT

FIS Technical – Copper Rolling 3 Month

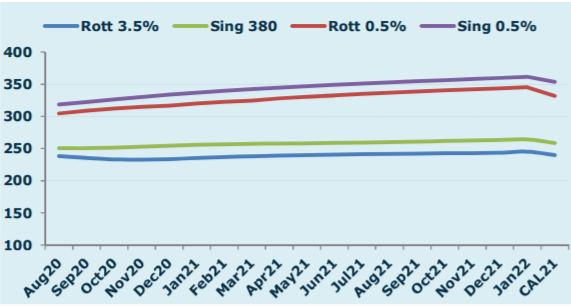

Fuel Oil Daily Evening Report

Steel and Scrap Update 8/7/20

*Physical scrap fixtures continue to be rangebound* A handful of physical fixtures have been reported over the past week, with traded levels holding relatively steady at around $255/t CFR. The most recent fixture was a UK based seller transacting a 15kT cargo, split across 14kT HMS 80:20 at $253/t and 1kT shredded scrap at $258/t …

Ferts in Focus 8/7/20

International paper prices flat through Q3 Futures curves remain relatively flat through the Q3 timeframe and into Q4 across intl urea paper contracts. Nearby values continue to move uniformly in line with physical, as the market awaits clear direction for where prices will go within the quarter. Arab Gulf prices firmer AG urea prices …

Tanker News Update 8/7/20

*Catastrophic Crack Margins* COVID-19 may have caused a tremor in the refining industry that will be seen for years to come. Simple refinery economics means profit is made in the differences on input (crude) and outputs (refined distillates). With global demand in refined products slumping in recent months their demand still isn’t growing enough to …