Monthly archives: July 2020

IRON ORE DAILY MARKET UPDATE

Market Commentary Iron ore futures advanced again on Tuesday, aided by bullish sentiment in China’s equity markets as well as concerns over near-term supply tightness. Following its best single-day percentage gain in about five years on Monday, the Shanghai composite were again higher on Tuesday, despite state media calling for retail investors to be rational, …

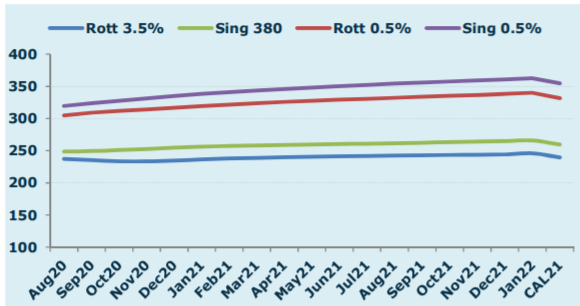

Monthly Fuel Oil Report

Capesize rallies further on tighter tonnage

Capesize rates rallied further without any signs of slowdown as the rates chased for new height for the year. Thus, the Capesize 5 time charter average surged by $1,078 day-on-day to $33,760 on Monday, with the curve trending up to highs for July, August, Sept and Q3 contracts. Following the Capesize rally, the Baltic Dry …

Continue reading “Capesize rallies further on tighter tonnage”

Oil and Ore Intraday Morning Technical

Oil Through the Looking Glass 7/7/20

*Rising US Virus Cases Dampening Sentiment* The US has reported significantly elevated numbers of new virus cases. Some 16 states are reporting record increases in new virus cases at the start of July. In California, hospitalisations have risen 50% over the past two weeks, with infections recorded infections rising more than This is limiting what would …

FIS Weekly Ferrous Report – profit takers loom as iron ore holds at high level

Ferrous Sector Money Flow: DCE iron ore saw significant money flow in the market and rebounded after a few weeks of consolidation. However during the Asian morning Tuesday iron ore stuck in an RMB 5-7 range again. DCE iron ore index created a gold cross on Monday near-oversold area. The high of the September contract …

Continue reading “FIS Weekly Ferrous Report – profit takers loom as iron ore holds at high level”

DCE rises amid mixed outlook

Chinese futures continued to rally for the second consecutive day despite mixed market outlook over steel demand and tight supply during summer season. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, rose by RMB 20 or 2.68% day-on-day to RMB 767 per tonne on Tuesday. Following the iron …