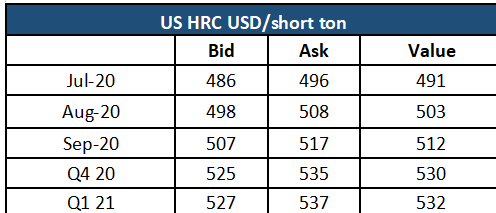

Ferrous Market Updates – Steelbank construction steel inventories 7.11 million tonnes, up 1.73% w-o-w. HRC inventories 1.84 million tonnes, up 1.08% w-o-w. – Tangshan announced a new round of environment protection and production curb started from July 5th. However details to be announced. – Some traders indicated currently seaborne iron ore were strong last week …

Monthly archives: July 2020

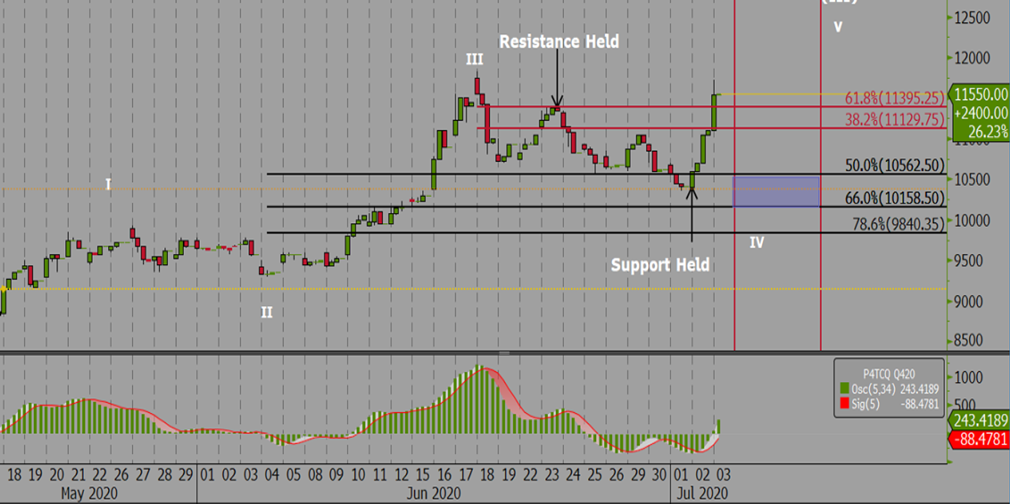

FIS Technical – DCE Iron Ore Sep 20

FIS Panamax Technical Report

Australian products overshadow Brazilian high-grade ores

A total of 3.05 million mt of iron ore was exchanged hands for the week ended Jul 3, up 26.60% week-on-week from previous week traded volumes. As usual, the Australian Pilbara Blend Fines (PBF) remained the most popular products among buyers, accounting nearly 34% of the trades. The next popular products went to Jimblebar fines …

Continue reading “Australian products overshadow Brazilian high-grade ores”

Pmx Q4 20 – revisited

Oil Through the Looking Glass 3/7/20

*OPEC’s Oil Basket Above $40* The collective prices of OPEC oil grades have pushed above $40 for the first time in four months. This falls in line with the slow-moving bullish sentiment that has been seen over the past couple of months as crude recovered for its lows in April. *US Lifts Some Venezuela …

Oil and Ore Intraday Morning Technical

Capesize rates rise over miners’ fixing spree

Capesize rates stayed above the $30,000 level due to the recent miners’ fixing spree in moving iron ore cargoes for arrival in China. The Capesize 5 time charter average reflected the firm freight market and spotted a gain of $438 day-on-day to $31, 377 on Thursday. This left the Baltic Dry Index (BDI) to seek …

Continue reading “Capesize rates rise over miners’ fixing spree”