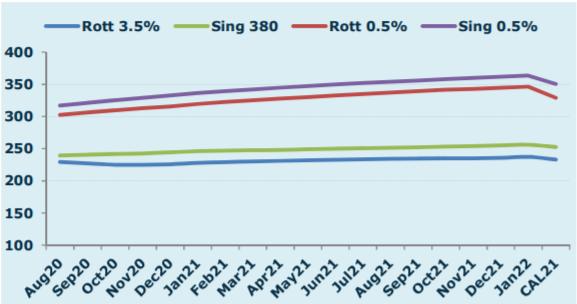

Good morning all. Brent crude futures were down 35 cents, or 0.8%, at $42.79 a barrel as of 0633 GMT, and U.S. WTI crude futures fell 35 cents, or 0.9%, to $40.30 a barrel. Both benchmarks rose more than 2% yesterday, buoyed by stronger-than-expected U.S. jobs data and a fall in U.S. crude inventories. For …

Monthly archives: July 2020

Freight Intraday Morning Technical

DCE ends the week on flat note

Chinese futures ended the week in positive despite mixed market outlook regarding the softening steel demand. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, rose slightly by RMB 5.00 or 0.67% day-on-day at RMB 746.50 per tonne on Friday. The steel rebar contract on the Shanghai Futures Exchange …

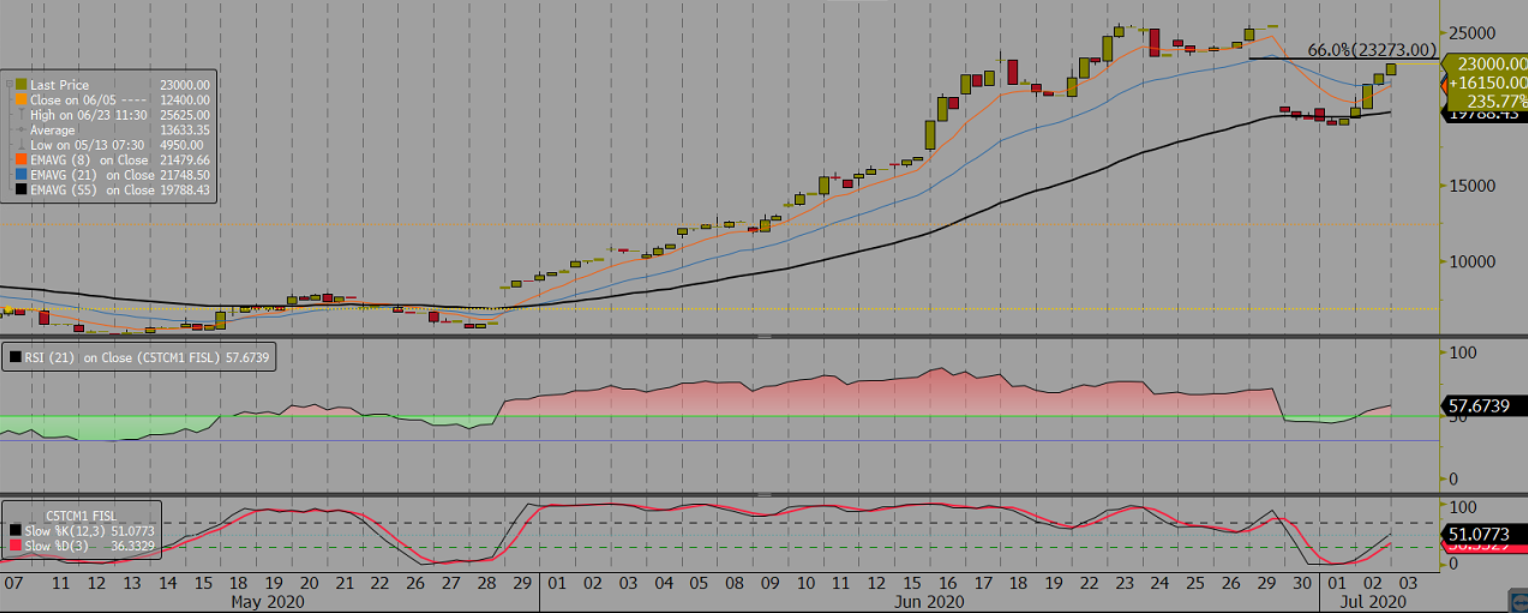

Iron Ore DCE September Daily Technical Review Jul 3rd

Verdict – Short-term neutral. DCE iron ore consolidate in narrow range, open interest continuously exhaust. Iron ore trading range stuck in 737 – 748.5 area for current four trading days. The bigger range from 733.0 to 752.0. Iron ore will keep consolidating if fail to breakthrough the current range. Be aware of Friday games, iron …

Continue reading “Iron Ore DCE September Daily Technical Review Jul 3rd”

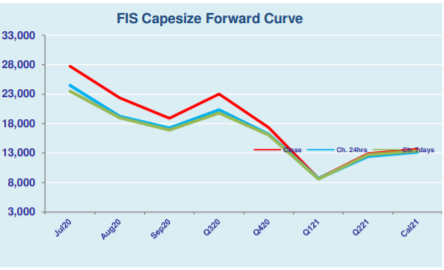

FIS Daily Physical Review Jul 3rd

Ferrous Market Updates – MySteel 45 ports iron ore inventory at 108.09 million tonnes, up 276,500 tonnes w-o-w. Daily evacuation 3.15 million tonnes down 50,000 tonnes w-o-w. Australia iron ore on ports at 61.49 million tonnes up 156,000 tonnes w-o-w. Brazil iron ore on ports at 22.42 million tonnes up 693,000 tonnes w-o-w. 147 ships …