*Europe Next on the Crude Splurge List* After the reports a few weeks ago of the Chinese increase in crude buying, it seems that this is now waning. China has bought so much crude that its inventories have hit a record 847.50 million barrels in the week that began June 22, Kpler data showed. With …

Monthly archives: July 2020

Freight Intraday Morning Technical

Capesize hovers above $30,000 level and BDI reaches year-high

Capesize rates stabilized at the $30,000 level, but the market remained at backwardation as some trade participants do not believe on the long-term strength of capes. Thus, the Capesize 5 time charter average saw a small gain of $79 day-on-day to $30, 857 on Tuesday. The Baltic Dry Index (BDI) also spotted small gain of …

Continue reading “Capesize hovers above $30,000 level and BDI reaches year-high”

Oil and Ore Intraday Morning Technical

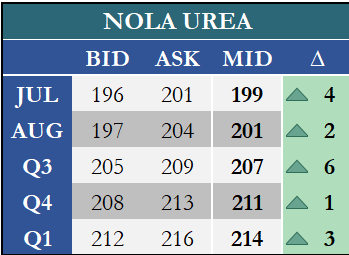

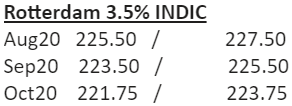

Fertilizer Financial Markets Commentary/Curves

Morning Oil Note 1/7/20

Oil futures rose this morning after lower than expected crude inventories in the United States, and despite an increase in coronavirus cases lightly obfuscating a positive demand outlook. At 3.45 am GMT front-month Brent futures were up 48 cents (1.2%), to $41.75 a barrel. WTI was up 54 cents (1.4%), at $39.81 a barrel. According …

DCE moves flattish amid high PMIs

Chinese futures remained almost flat for Wednesday, till a selldown in the afternoon session that led to a negative closing. The most-actively traded iron ore futures on the Dalian Commodity Exchange (DCE), for September delivery, went down slightly by RMB 2.00 or 0.27% day-on-day at RMB 742 per tonne on Wednesday. Similarly, the steel rebar …