Monthly archives: July 2020

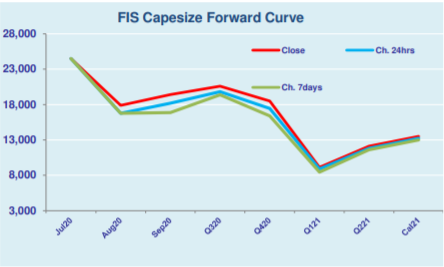

Capesize rates brace for sharp rebound amid new Covid-19 wave

It was a choppy day for the Capesize rates as some market participants were concerned over a new wave of Covid-19 that might delay vessel schedules. However, the paper market is expected to make a sharp rebound with front end futures nearly up by $2,000 on Wednesday, following by increase of $1,500 on Tuesday, especially …

Continue reading “Capesize rates brace for sharp rebound amid new Covid-19 wave”

Freight Intraday Morning Technical

Fertilizer Financial Markets Commentary/Curves

Steel & Scrap Morning Report

Tanker News Update 29/7/20

*Chinese Flooding China is currently experiencing its worst floods in 100 years with record rainfall levels since June. Areas straddling the Yangtze river banks are at risk of severe flooding if they haven’t already. Sinopec owns multiple refineries along the river so increased rainfall could cause serious issues. Potentially manifesting into catastrophic issues if the …

Ferts in Focus 29/7/20

MMTC back tendering immediately This past week saw India back tendering for urea straight after closing the previous round, following disappointing participation at less than 10% of their target. A tender was expected to be announced on short notice, but the one day turnaround between confirmation of acceptances and opening the next tender, once again …

DCE rebounds over tight supply

Iron ore futures inched up at the closing of the afternoon session over supply tightness of mid-grade ores among portside stocks. Thus, the most-traded iron ore for September delivery on China’s Dalian Commodity Exchange rose by 2.31% or RMB 19 day-on-day to RMB 841.50 per tonne on Wednesday. Then, the steel rebar contract on the …