*Geopolitical Angst and Rising Virus Cases Weigh in Market The escalating tensions between China and the United States has left the market shaky. The consulate closing dispute is the latest move by the two countries which started with a trade war last year. According to data from John Hopkins University, global COVID-19 case counts have …

Monthly archives: July 2020

Oil and Ore Intraday Morning Technical

DCE drops on market uncertainty and rising US-China tension

Iron ore futures slid on start of the week, continuing the correction phrase seen last week on bearish market sentiments and rising US-China tension. The most-traded iron ore for September delivery on China’s Dalian Commodity Exchange dropped by 1.99% or RMB 16.50 day-on-day to RMB 814.50 per tonne on Monday. Following the drop, the steel …

Continue reading “DCE drops on market uncertainty and rising US-China tension”

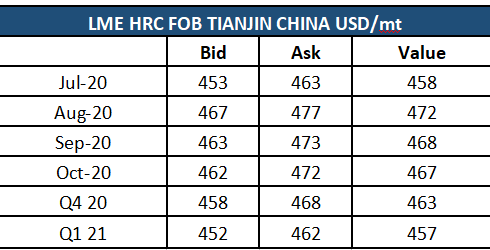

Steel & Scrap

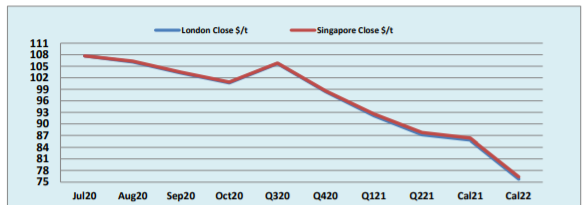

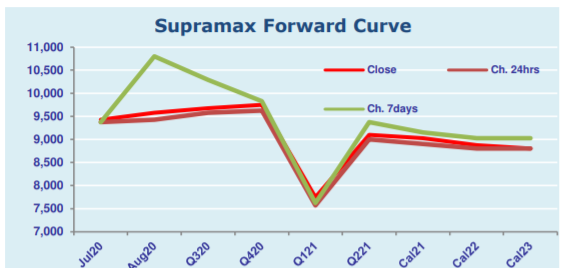

Freight Intraday Morning Technical

FIS Fuel Oil Morning Report 27/07/2020

Brent futures were down 8 cents/b, or 0.18%, to $43.26/b by 3:15 am GMT, while WTI futures were down by 4 cents/b, or 0.1%, at $41.25/b. The drop of oil prices mirrored moves in broader financial markets in Asia amid concerns about escalating tensions between the world’s two biggest economies following the closures of consulates …

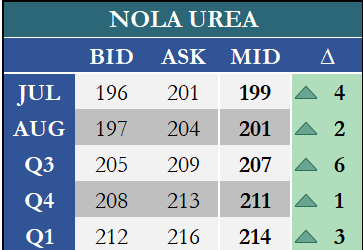

Fertilizer Financial Markets Commentary/Curves

Daily Ferrous Physical Review Jul 27th

Ferrous Market Updates – Steelbank Inventory: rebar inventories 7.52 million tonnes, up 2.38% w-o-w. HRC 1.84 million tonnes, up 1.85%. – China H1 pig iron production 432.68 million tonnes, up 2.2% y-o-y. Crude steel production 499.01 million tonnes, up 1.4% y-o-y. – China metallurgical research institution said China steel per GDP will decrease in long …