What is going on with this iron ore market? How come freight is flying again? Why is nothing moving on oil? Memes aside, join the team to discuss the week’s movements and idiosyncrasies. Available now on the FIS website (www.freightinvestorservices.com/media ) Spotify https://open.spotify.com/show/7yMLsm5s8tLtrCQr7bG8wD?si=FW6Rvj9HRjClAx3vRjq8iw And Apple https://podcasts.apple.com/sg/podcast/fis-castaway/id1507094242 Disclaimer: This podcast is a marketing communication and is not based upon …

Monthly archives: August 2020

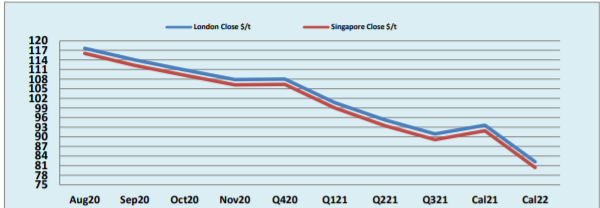

Fertilizer Financial Markets Commentary/Curves

FIS LONDON COKING COAL MARKET REPORT

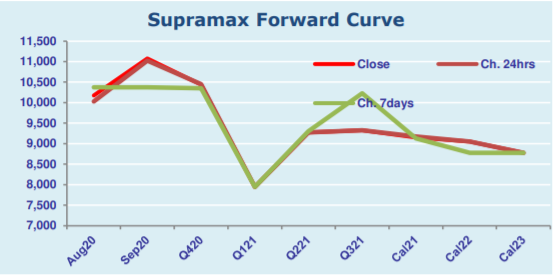

Supramax & Handysize FFA Daily Report

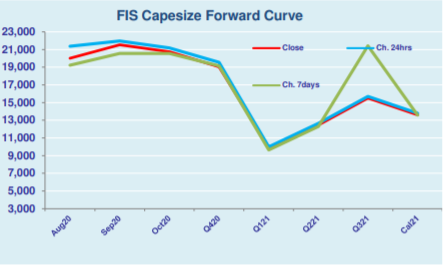

Capesize & Panamax FFA Daily Report

London Iron Ore Market Report

Fuel Oil Daily Evening Report

Daily Ferrous Physical Review Aug 6th

Ferrous Market – Lianyun Port ships congested because some crew are tested positive of Covid-19. The rest of northern ports are operating normally. Ships at northern are also impacted shortly by the previous typhoon. – MySteel Rebar Inventory: Rebar production 3.84 million tonnes, down 0.74% w-o-w. Mills inventory 3.49 million tonnes, down 0.33% w-o-w. Circulation …

Oil Through the Looking Glass 5/8/20

Heavy Crude to Lose Ground The announcement that OPEC is relaxing its production cuts could signal the end of the bull run on heavier crude and products. The OPEC cut has seen heavier crude in significant demand, this is especially true of residual products like high sulphur fuel oil which have seen increased demand from …

Speculation sees iron ore advance above $112/tonne

Iron ore futures advanced above $112 a tonne on Wednesday amidst of fresh waves of speculative trading seen in the market. Rebar and iron ore were supported after hearing that steel inventory is down this week. Steel inventory data by Mysteel is due to be released tomorrow. At the same time, there are signs that …

Continue reading “Speculation sees iron ore advance above $112/tonne”