Verdict:

• Short-run Neutral.

Macro:

• The jobless files for US last week at 242,000, est. 225,000, last 229,000. US May PPI up 2.2%, est. up 2.5%, last up 2.2%.

• EIA estimated a surplus of 8 million barrels of crude oil supply in 2030.

Iron Ore Key Indicators:

• Platts62 $106.60, +1.45, MTD $107.24. The market saw bottom hunting physical buyers during past three days from China, which supported iron ore market finally as we expected. There were JMBF, MACF and NHGF trades yesterday, majorly through fixed price, indicating a strong demand in short-run.

• China 45 ports iron ore inventories at 148.92 million tons, down 35,000 tons from last week. Daily evaluations 3.09 million tons, down 34,400 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 13th)

• Futures 117,039,000 tons(Increase 2,159,400 tons)

• Options 164,336,700 tons(Increase 1,385,000 tons)

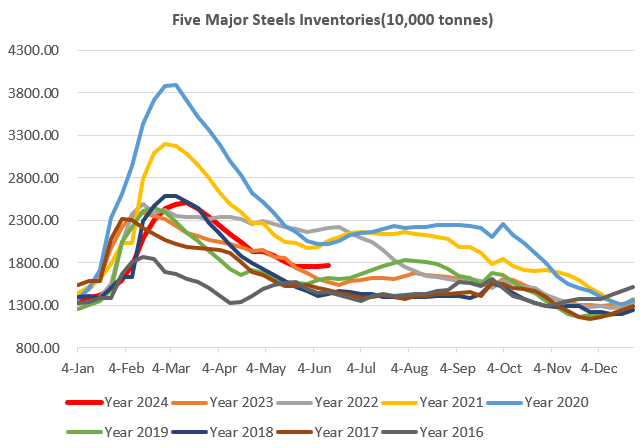

Steel Key Indicators:

• China pig iron production at 2.39 million tons, up 35,600 tons on the week. China blast furnace utilisation rate at 89.53%, up 1.39% on the week.

Coal Indicators:

• The bid and ask spread widened in FOB Australia market. HCCA offered at $270 on globalCOAL, while the bids were $239 currently.