Verdict:

• Short-run Neutral.

Macro:

• China M2 for May up 7.0% on the year, M1 down 4.2% on the year. M2- M1 spread widened to 11.2%, refreshed the highest since January 2022.

• China May Industrial Value Added Amount above designated scale up 5.6%, last 6.7%.China May House developing investment down 10.1%, last down 9.8%. China NBS: China produced 92.86 million tons of crude steel in May, up 2.7% on the year. China total produced 438.61 million tons of crude steel from January to May, down 1.4% on the year.

Iron Ore Key Indicators:

• Platts62 $107.65, +1.05, MTD $107.29. The iron ore market saw resistance as south China rainy season decreased steel consumption in June and July, while shipment of iron ore were high in June. On the other side, physical traders tend to buy seaborne iron ore as good landing margin whenever seeing a drop on futures price, which supported current iron ore price from sharp correction.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 14th)

• Futures 118,969,300 tons(Increase 1,930,300 tons)

• Options 165,333,700 tons(Increase 997,000 tons)

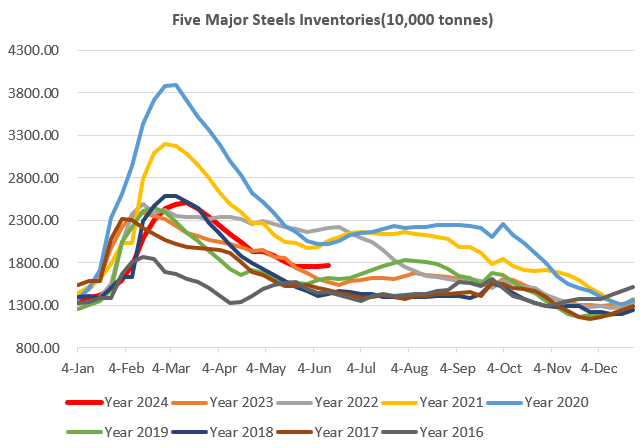

Steel Key Indicators:

• MySteel estimated May sample steel mills average rebar production loss at -13 yuan/ton, down 89 yuan/ton on the month. HRC average profit at 33 yuan/ton, down 119 yuan/ton on the month.

Coal Indicators:

• China coking coal market was muted, waiting for the consequence of Q3 term contract on FOB seaborne materials.