Verdict:

• Short-run Neutral.

Macro:

• EU Comission will launch a technical conference with China regarding to the current plan on imposing EVs import duty.

Iron Ore Key Indicators:

• Platts62 $102.65, -2.45, MTD $106.72. Steel demand became slower as China entered rainy weather in southern areas and extreme high temperature in northern cities. Thus, mills started to control both production volume and cost. Discount iron ores were popular compared to premium ores. If the steel margin and landing margin both narrows in next few weeks, seaborne iron ore demand will in general face pressure.

• During the past week, China 45 iron ore ports arrivals at 24.73 million tons, up 2.656 million tons on the week. Brazil and Australia delivered 28.328 million tons of iron ore, down 280,000 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 24th)

• Futures 129,635,000 tons(Increase 2,666,800 tons)

• Options 174,847,100 tons(Increase 2,145,500 tons)

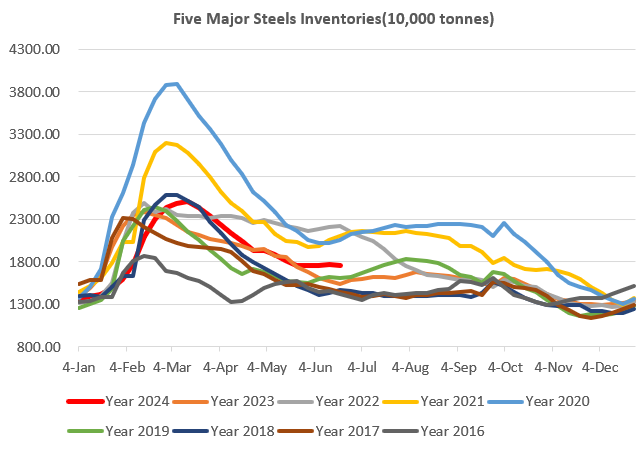

Steel Key Indicators:

• European domestic HRC was EUR640-650 EXW, which was EUR 5 lower than last week. FOB Tianjin was $528, $5 lower on the week.

Coal Indicators:

• The upcoming Moonson weather resisted coking coal demand from India. The FOB Australia coking coal maintained unchanged for index, however the offers potentially lower if it take longer time for firm bids on market.