Verdict:

• Short-run Neutral.

Macro:

• US PCE index for May grew 2.6% on the year, flat from estimation, which supported the interest cut expectation. The interest cut probability raised from 64% to 68% after the news.

• Panama Canal began to gradually increase daily transits from July 22nd. The Canal expected to increase maximum number of ships from 32 to 35 by August 5th.

Iron Ore Key Indicators:

• Platts62 $106.70, +0.95, MTD $106.51. Iron ore saw smaller trading range on last Thursday and Friday. Sellers were expecting higher price on the market. However buyers were not urgent to stock raw materials at the moment. Thus, the divergence between sellers and buyers led to quiet trading activities on physical side. The current high silica iron ore were traded at lower price indicated a decreasing demand. However, the high grade Brazilian iron ore including IOCJ was in tight supply.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 28th)

• Futures 102,867,900 tons(Decrease 26,690,200 tons)

• Options 143,665,100 tons(Decrease 32,819,100 tons)

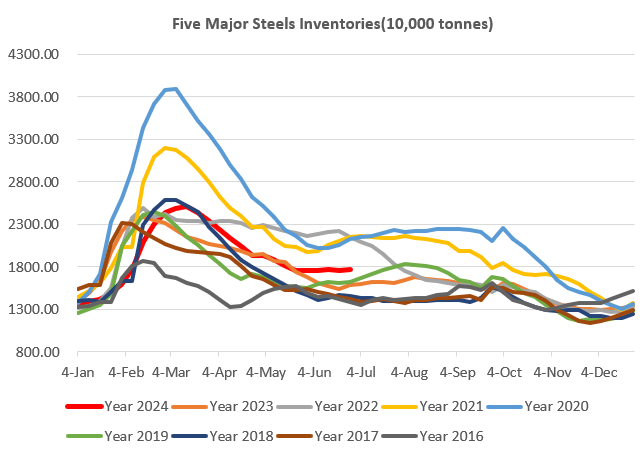

Steel Key Indicators:

• China 247 sample steel mills average pig iron production utilisation rate at 89.13%, down 0.63% on the week. Daily pig iron production at 2.3944 million tons, down 5,000 tons on the week.

Coal Indicators:

• The FOB Australia market saw decrease on price as expected after buyers slowed down the purchases. Sellers have to make lower offers to attract buyers