Verdict:

• Short-run Neutral.

Macro:

• Both S&P 500 and Nasdaq hit new closing highs on Tuesday, driven by the rise of Nvidia. Earlier, Federal Reserve Chairman Powell told lawmakers that more “good” economic data would strengthen the reason for interest rate cuts. The S&P 500 index rose 0.07% to close at 5576.98. The Nasdaq index rose 0.14% to 18429.29.

Iron Ore Key Indicators:

• Platts62 $109.60, +0.95, MTD $110.98. The seaborne market saw bottom hunting buyers yesterday as we expected. There were JMBF and NHGF trades. However PBF interest vanished because of a negative landing margin.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 9th)

• Futures 106,872,200 tons(Increase 756,500 tons)

• Options 152,123,600 tons(Increase 683,000 tons)

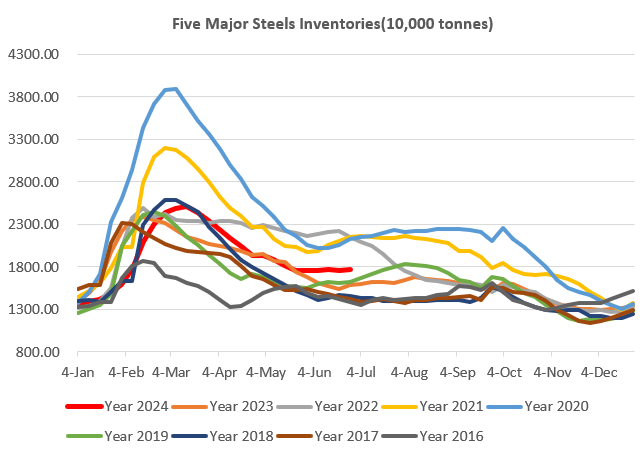

Steel Key Indicators:

• According to MySteel researched 247 steel mills, the average pig iron daily production reached 2.28 million tons, down 92,500 tons/day on the year. MySteel estimated a 20-30 million tons decrease on pig iron production in 2024 compared to 2023.

Coal Indicators:

• The FOB Australia market entered a quiet mode, the indicative buyers for PMV was $265-270 CFR India.