Verdict:

• Short-run Neutral.

Macro:

• China H1 GDP amount at 61.68 trillion yuan, GDP growth rate up 5% on the year. China H1 industrial value added amount above designated scale up 6% on the year.

Iron Ore Key Indicators:

• Platts62 $108.75, +0.75, MTD $109.75.

• Rio Tinto Q2 iron ore production at 79.5 million tons, up 2% on the quarter, down 2% on the year. Total delivery at 80.3 million tons, up by 3% on the quarter, up 2% on the year.

• Australia and Brazil total shipped 24.73 million tons of iron ore last week, down 493,000 tons on the week. China 45 ports iron arrivals at 28.656 million tons, up 783,000 tons on the week.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 15th)

• Futures 108,143,800 tons(Increase 93,500 tons)

• Options 155,270,000 tons(Increase 914,900 tons)

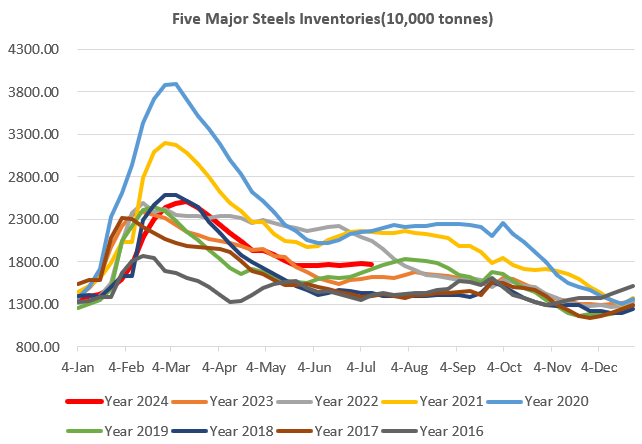

Steel Key Indicators:

• China NBS: China produced 91.61 million tons of crude steel in June, up 0.2% on the year.

• CISA: China crude steel daily production at 2.15 million tons in mid-July, down 0.73% from early July.

Coal Indicators:

• The FOB Australia coking coal index collapsed by $13, eyeing huge amount of reselling interest from southeast Asia. The market is oversupplied for front month cargoes.