Verdict:

• Short-run Neutral.

Macro:

• IMF predicted 3.2% and 3.3% growth on global economy in 2024 and 2025 respectively. IMF increased China economy growth from 4.6% to 5%. IMF decreased US economy growth from 2.7% to 2.6%.

• Physical gold up 1.92% yesterday, refreshed historical high at $2468.7/oz.

Iron Ore Key Indicators:

• Platts62 $107.25, -1.50, MTD $109.54. The premium of mainstream concentrates corrected fast as competitive alternatives as well as the squeezing physical steel margin. However the recovery of virtual steel margin as well as landing margin potentially signals a rebound on physical margin, which would support iron ore from deep correction in future.

• Vale Q2 iron ore production at 80.598 million tons, up 13.8% on the quarter, up 2.4% on the year. Total sales at 79.79 million tons, up 25% on the quarter, up 7.3% on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 16th)

• Futures 108,490,600 tons(Increase 346,800 tons)

• Options 156,167,100 tons(Increase 897,100 tons)

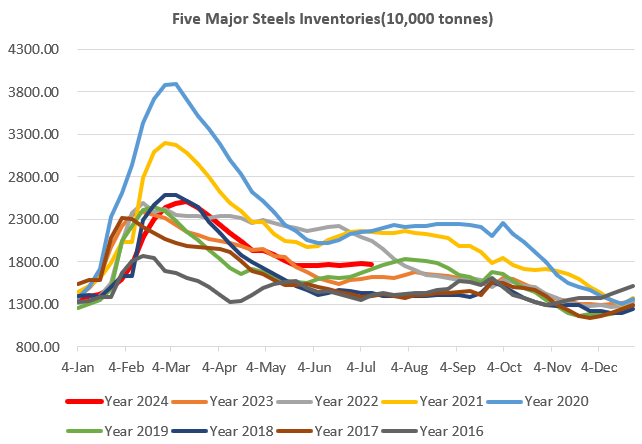

Steel Key Indicators:

• HRC SS400 FOB Tianjin fell $6 to $521 during past week because of India was discussing to increase steel import tariffs.

• MySteel researched 91 blast furnace, rebar June average at 3502 yuan/ton, production loss at 98 yuan/ton, down 85 yuan on the month. HRC average cost at 3615 yuan, production gain at 19 yuan/ton, down 14 yuan/ton on the month.

Coal Indicators:

• The FOB coking coal market saw weakened demand from both India and China. The index softened because of unsold June, July and August laycans.