Verdict:

• Short-run Neutral.

Macro:

• According to NAR, US home sales at 3.89 million units in June, down 5.4% on the month, refreshed lowest since December, 2023.

• Russia reimposes gasoline export ban for August, potentially extend this ban for further months if necessary.

Iron Ore Key Indicators:

• Platts62 $100.40, -2.80, MTD $107.81. JMBF announced September long-term discount at $7.31/mt. MACF term discount for September at $4.42/mt. Platts indicated that BHP potentially offered its first discount in history at $2.63/mt, yet to receive official confirmation from BHP. The discount on premium products indicated the weak sentiment on the market.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 23rd)

• Futures 115,380,600 tons(Increase 3,650,100 tons)

• Options 160,832,500 tons(Increase 1,496,500 tons)

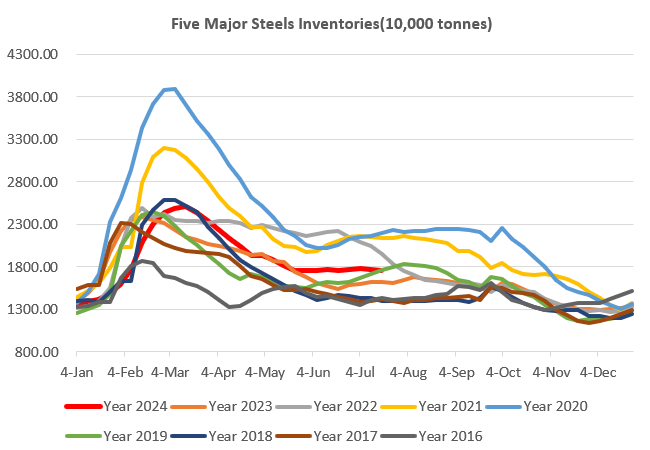

Steel Key Indicators:

• Many steel mills in Yunnan province, China announced to prevent steel price from further decrease in late July.

• World Steel Association statistic indicated that global steel production reached 161.4 million tons, up 0.5% on the year in June. China produced 91.61 million tons, up 0.2% on the year. India produced 12.3 million tons, up 6% on the year. US produced 6.7 million tons, down 1.5% on the year.

Coal Indicators:

• The PLV offer for $230 was down to $227 after no buyers for five business days.