Verdict:

• Short-run Neutral.

Macro:

• EIA reported that as of the week of July 19th, US crude oil inventories decreased by 3.7 million barrels to 436.5 million barrels. Previously, Reuters survey analysts estimated a decrease of 1.6 million barrels.

• China Ministry of Finance statistic indicated that H1 2024 state-owned companies total revenues at 40.83 trillion yuan, up 1.9% on the year.

Iron Ore Key Indicators:

• Platts62 $100.85, +0.45, MTD $107.42. As expected, there were bottom hunting buyers after a sharp drop on iron ore during this week. There two laycans of MACF, one BRBF and one PBF traded in fixed price, calculated to slight less than $100, indicating a physical support on this level.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 24th)

• Futures 118,024,400 tons(Increase 2,643,800 tons)

• Options 162,689,500 tons(Increase 1,857,000 tons)

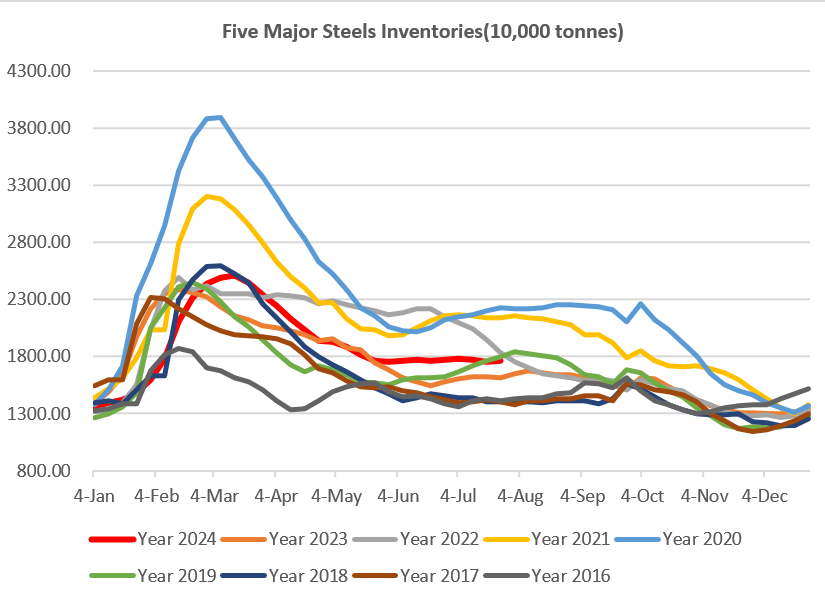

Steel Key Indicators:

• According to data from the China Iron and Steel Association in mid-July , major steel companies produced a total of 21.48 million tons of crude steel, 19.26 million tons of pig iron, and 20.37 million tons of steel. Among them, the daily production of crude steel was 2.15 million tons, a month on month decrease of 0.16%, a year-on-year decrease of 4.42%.

• After Yunnan province announced to protect steel price in late July. Major mills in Shandong announced to prevent price from further decrease in late July because of the thin margin.

Coal Indicators:

• After the consecutive drop on PLV offers during the current two weeks, European steel makers finally conclude the deal at $225/mt. Thus, index stablised yesterday. However Indian buyers were expecting further correction.