Verdict:

• Short-run Neutral to Bullish.

Macro:

• The Eurozone GDP in Q2 after adjusted increased by 0.6% on the year and 0.3% on the month, both higher than market expectations.

• Glencore copper production in H1 2024 was 462,600 tons, decreased by 5% on the year. Nickel production decreased by 5% at 44,200 mt. Zinc production down 4% to 417,200mt.

Iron Ore Key Indicators:

• Platts62 $99.00, -2.45, MTD $106.17. The market tanked yesterday following the news that Vietnam potentially launch anti-dumping tax against steel products from China and India, which were two major iron ore importers over the world. In mid-run, iron ore saw pressure on high arrivals in Asia as well as high inventories in China. However, iron ore recovered some losses after an oversold yesterday. The past correction was also related to a general correction across all high liquidity commodities and equities concerning unexpected growth in major economies.

SGX Iron Ore 62% Futures& Options Open Interest (Jul 30th)

• Futures 127,648,600 tons(Increase 3,579,000 tons)

• Options 167,854,000 tons(Increase 1,005,000 tons)

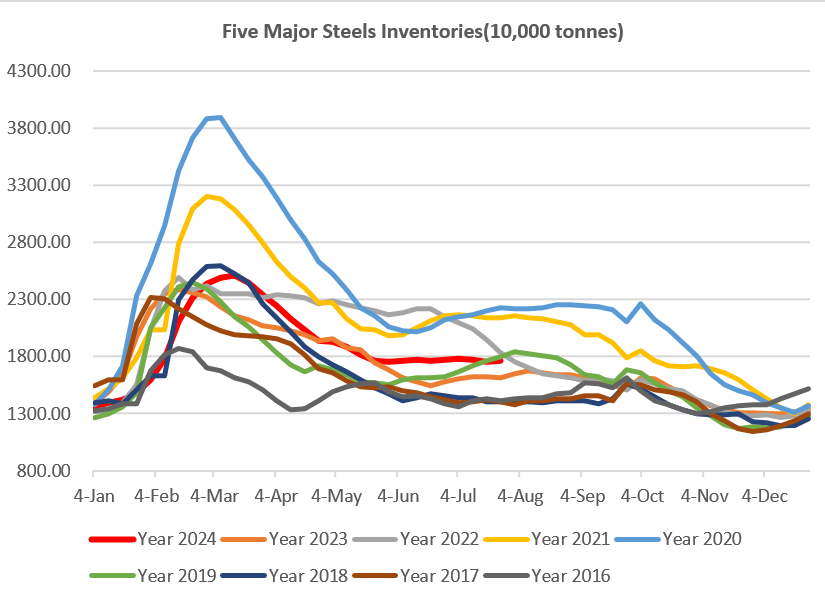

Steel Key Indicators:

• Traders were worried about the export tariff launched by Vietnam, because Vietnam market accounted for 11.9% of total steels exported from China in H1 2024.

• Brazil half-finished steels dropped to low of the quarter following a year-low mid-west US HRC, which EXW price dropped by 40% from the beginning of the year to $750/mt during this week.

Coal Indicators:

• Although the FOB Coking coal approached two-year low level, buyers were waiting for bottom out of market.