Verdict:

• Short-run Neutral.

Macro:

• BOE cut interest rate by 25 bps to 5%, as expected from the market previously, the first interest cut since early 2020.

• The jobless claims of US last week increased by 14,000 to 249,000, refreshed single week high in 2024, est. 236,000.

• Eurozone July PMI 45.8, est. 45.6, last 45.6.

Iron Ore Key Indicators:

• Platts62 $102.30, +1.35, MTD $102.30. The trade activity maintained sluggish yesterday as a macro bearish sentiment hit global equity and commodities. China 45 ports iron ore inventories at 150.90 million tons, down 1.89 million tons on the week, up 28.00 million tons on the year. Daily evaluations at 2.98 million tons, down 227,000 tons on the week, down 24,000 tons on the year. China mills inventories at 91.23 million tons, down 821,900 tons on the week, up 7.94 million tons on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 1st)

• Futures 109,421,000 tons(Increase 2,349,500 tons)

• Options 137,927,000 tons(Increase 746,500 tons)

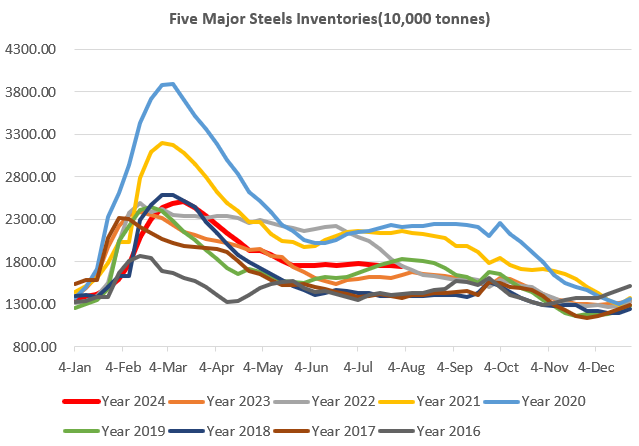

Steel Key Indicators:

• China pig iron production during past week reached 2.3662 million tons per day, down 29,900 tons on the week, down 43,600 tons on the year.

Coal Indicators:

• China Hebei province cut physical coke price by 50- 55 yuan/ton, which was the second round of price cut from last week.