Verdict:

• Short-run Neutral to Bullish.

Macro:

• US jobless rate up by 4.3% in July, refreshed three-year-high, strengthening the concerns on recession. US Labor Department published non-farm payrolls increased by 114,000 in July, est. 175,000. The expectation on interest cut increased after traders saw these data.

• According to a Reuters survey, the increase in OPEC oil production in July, the increase in Saudi Arabia’s supply, and the slight increase in production in some other countries outweighed the impact of voluntary production cuts by other member countries and OPEC+.

Iron Ore Key Indicators:

• Platts62 $103.55, +1.25, MTD $102.93. The trade activity maintained sluggish last week. There was JMBF traded at discount of $7.48/mt based on September index. The indicative PBF value arrived in early September was $103.85 – $104.3/mt. Most of traders were still in a wait-and see mode because of proactive maintenance for steel mills. The reversal of the market depend on the start of restocking for September, which was normally a busy month.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 2nd)

• Futures 109,995,500 tons(Increase 574,500 tons)

• Options 138,117,800 tons(Increase 190,800 tons)

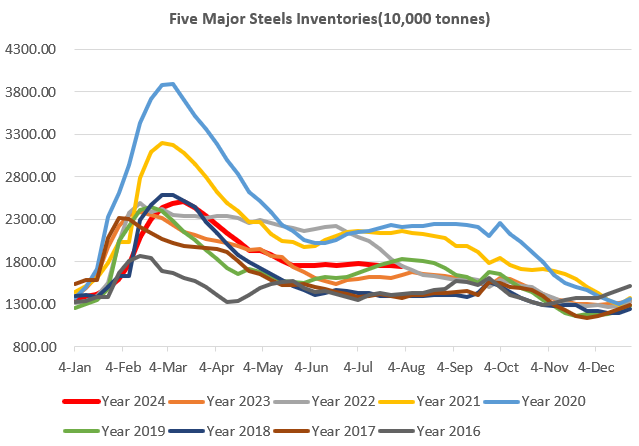

Steel Key Indicators:

• China sample steel mills iron ore inventories was 91.23 million tons, a month on month decrease of 821,900 tons, and a year-on-year increase of 7.94 million tons. The utilization rate of blast furnace capacity was 88.87%, a month on month decrease of 0.74% and a year-on-year decrease of 1.19%.

Coal Indicators:

• The coking coal price decrease slowed down in FOB Australia market during past week. Sellers offered down $2 last Friday on platform and soon traded at $215/mt, indicating the price level was close to the buyers expectation. Thus, index potentially stablise in the area $205 – $215.