Verdict:

• Short-run Neutral.

Macro:

• China Ministry of Commerce and seven other departments increased subsidy standards for scrapped automobiles, and raised the subsidy standards for purchasing new energy passenger vehicles and fuel passenger vehicles to 20,000 yuan and 15,000 yuan from 10,000 yuan and 7,000 yuan respectively.

• Mining group BHP Billiton announced that it has reached an agreement with unions to resolve the strike at the Escondida copper mine in Chile, easing concerns about global supply. LME copper price fell after the news.

Iron Ore Key Indicators:

• Platts62 $91.90, -0.85, MTD $99.01. The demand of iron ore decrease for several weeks in August. However, the iron ore inventories were maintaining slow decreasing pace. A reversal of market need some expectations on recovery of demand in September.

• China steel mills blast furnace utilisation rate 85.92%, down 1.1% on the week, down 5.87% on the year. Daily pig iron production at 2.29 million tons, down 2.93% on the week, down 16.86% on the year.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 16th)

• Futures 132,052,900 tons(Increase 3,296,800 tons)

• Options 159,809,500 tons(Increase 1,105,500 tons)

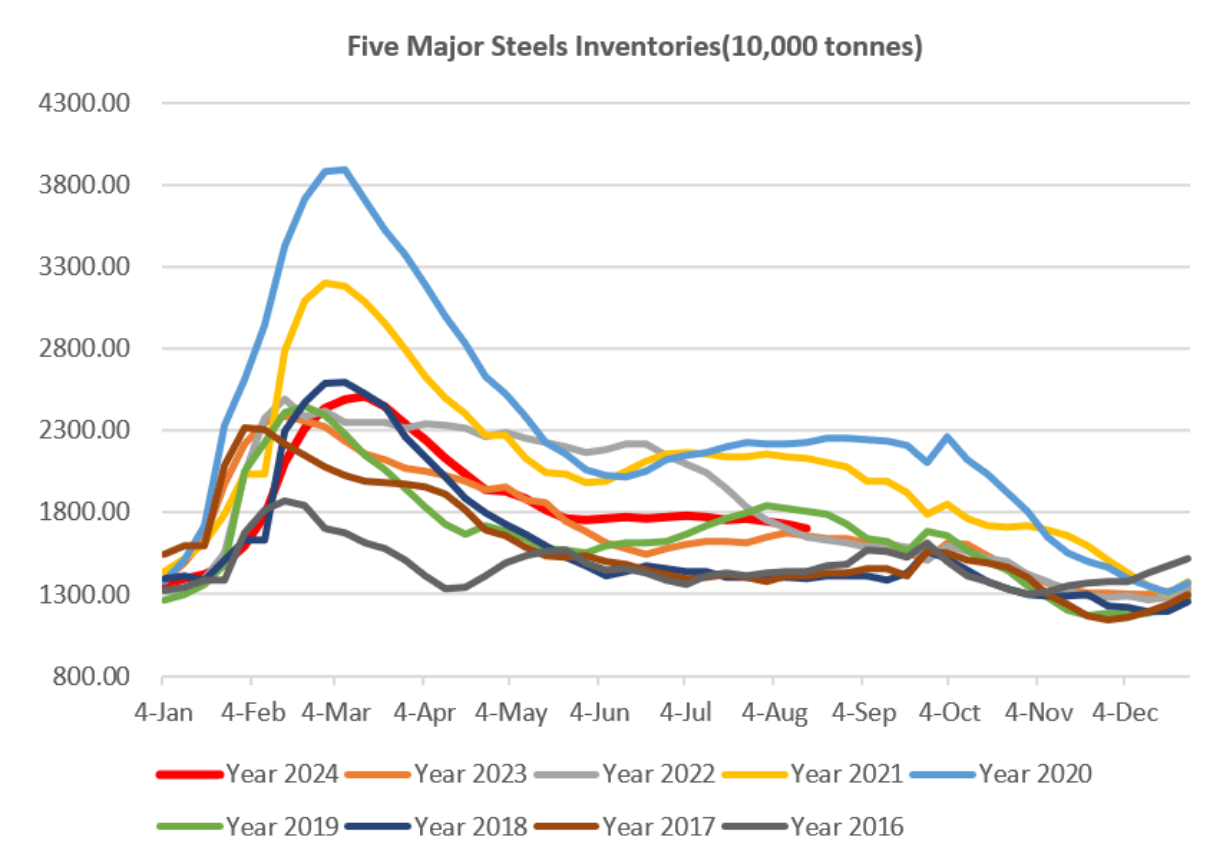

Steel Key Indicators:

• China cold rod coil reached 3500 yuan/ton in some areas, refreshed the lowest of the past five years. The last low was created in late April, 2020. The sales of finished steels were frozen in August.

Coal Indicators:

• China Customs: China imported 46.21 million tons of coal in July, a year-on-year increase of 17.7%. From January to July, the cumulative imports were 295.78 million tons, a year-on-year increase of 13.3%.