Verdict:

• Short-run Neutral to Bullish.

Macro:

• Goldman Sachs indicated that China crude oil demand in 2025 should maintain stable, estimated crude oil price at $68/b.

Iron Ore Key Indicators:

• Platts62 $95.10, +0.65, MTD $98.36. The physical iron ore market became active from this week, eyeing significant growth of discount cargoes trades. There were two MACF trades at $88.8 and $88.9 respectively, however the MACF discount widened from $2.75 to $2.95 because of the current growth on stocks.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 20th)

• Futures 134,055,800 tons(Increase 1,422,600 tons)

• Options 160,816,100 tons(Increase 409,200 tons)

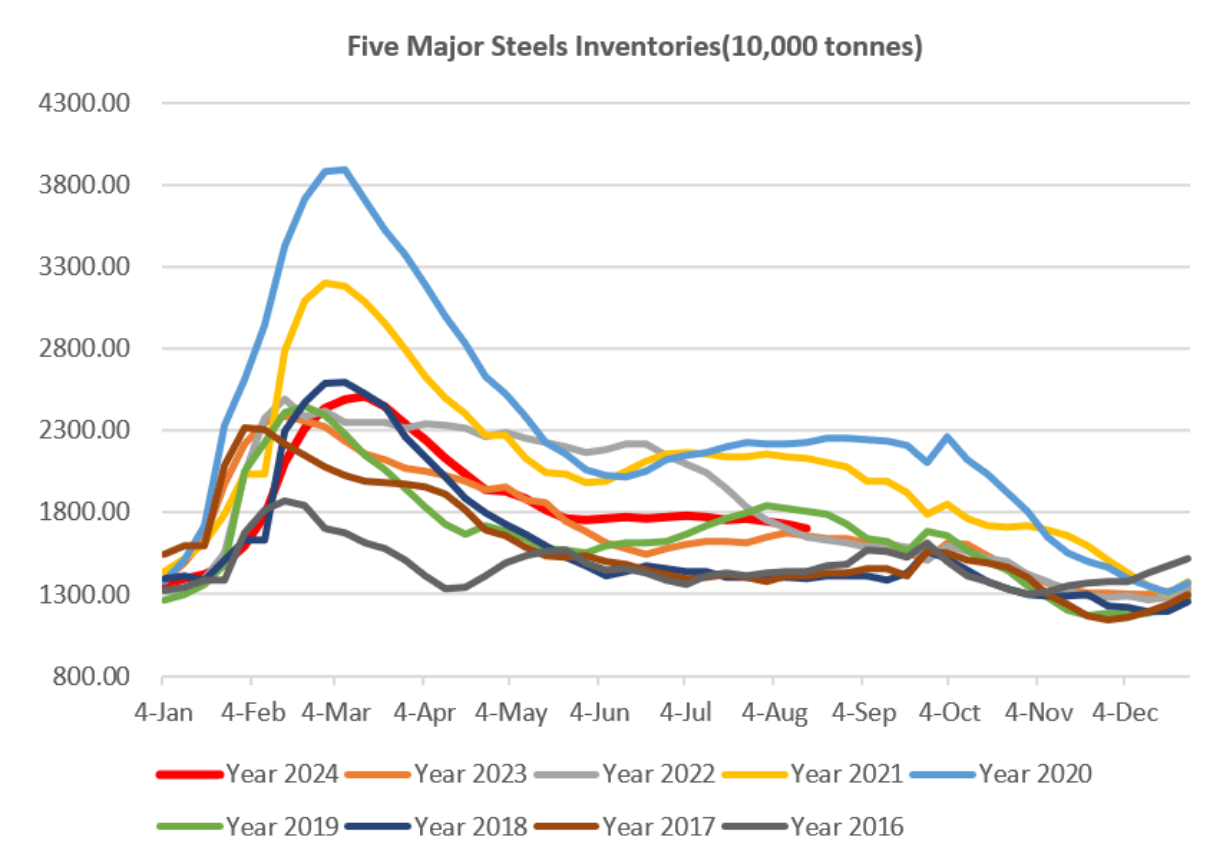

Steel Key Indicators:

• The sales pressure of China rebar produced with old national standards decreased during this week. Many mills planned to finish sales on old rebar and start to produce rebar following new standards in September.

Coal Indicators:

• Buying interests had been consistently heard from the Indian market. At the same time, futures market of ferrous in general start to rebound this week. Physical traders expected a rebound following China and India restock in late August.