Verdict:

• Short-run Neutral to Bullish.

Macro:

• According to US Federal notes overnight, the Federal expected to cut interest rate once in September, and one more cut in late 2024. The Federal expected an ease monetary condition in 2025.

Iron Ore Key Indicators:

• Platts62 $97.90, +2.80, MTD $98.33. As we expected from this Monday, market started recovery with strong seaborne trades during the week, regardless the depreciation on US dollar. There were float trade on BRBF and PBF. NHGF was traded at $95/mt. MACF was traded at $93.8/mt. The bottom hunting traders emerged obviously. However, a fast pick-up would potentially make buyers to reconsider the cost currently. Iron ore potentially maintain strong demand during this week.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 21st)

• Futures 137,105,100 tons(Increase 3,049,300 tons)

• Options 161,644,600 tons(Increase 828,500 tons)

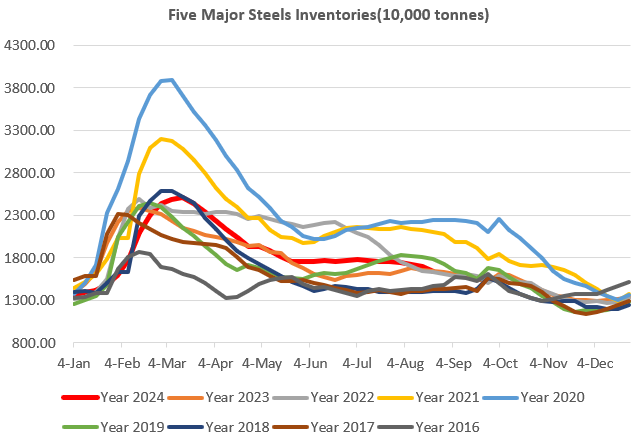

Steel Key Indicators:

• China Shagang Group cut rebar price by 100 yuan/ton to 3450 yuan/ton. Wire rods price was cut by 100 yuan/ton to 3460 yuan/ton.

• Tangshan billet cost at 3184 yuan/ton, down 99 yuan/ton on the week, average steel making loss at 244 yuan/ton.

Coal Indicators:

• MySteel estimated China coal washery plants operation rate at 67.29%, up 1.09% on the week. Daily production at 567,100 tons, up 14,700 tons on the week.

• China steel mills proposed a 50-55 yuan/ton cut on physical coke for the six rounds.