Verdict:

• Short-run Neutral to Bullish.

Macro:

• US dollar appreciated because of technical buying. Previously, US dollar index once reached year-low. The traders were waiting for new changes on the interest cut stories.

Iron Ore Key Indicators:

• Platts62 $100.45, -0.65, MTD $98.49. The seaborne iron ore trades were increased significantly yesterday. Both PBF and MACF were traded $1 higher than Tuesday at $101.6 and $98.5 respectively. JMBF was traded at $7.7 discount and October index, which was $0.1 wider than last week. In general, the physical market was stronger than futures market during the late half of the week. The restock of iron ores is sustainable.

SGX Iron Ore 62% Futures& Options Open Interest (Aug 28th)

• Futures 146,303,100 tons(Increase 1,404,100 tons)

• Options 167,998,100 tons(Increase 373,000 tons)

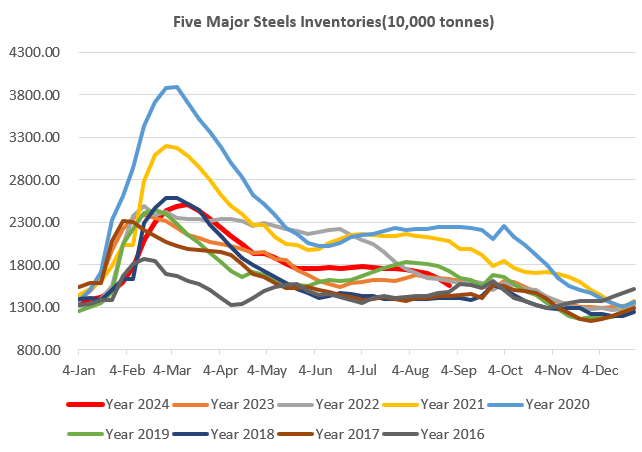

Steel Key Indicators:

• Tangshan average billet cost 3160 yuan/ton, down 24 yuan/ton on the week. Average production loss at 190 yuan/ton, down 94 yuan/ton on the week.

Coking Coal and Coke Indicators:

• China physical coke saw the seventh round of cut by 50- 55 yuan/ton, total down 350 – 385 yuan/ton.