2020 is taking the phrase annus horribilis to a new level for the Capesize 5tc market. The big sisters rarely have anything to celebrate in the first few months of the year, like a tourist spot emerging from lockdown, owners know that they to make hay when the sun is shining.

Index values are at the lowest in five years and remain below the USD 5,000 a day level. For a Capesize owner, life is determined by seasons. In early March you plant a seed under cover. In late March you have some movement, at the end of April you plant out, there is a pause, the plant can get a little smaller them boom, the season begins.

The Capesize Market is basically the four seasons of the UK. This year the Capsize index got caught by a late frost, but that does not mean the summer is over. In fact, based on 2019 iron ore disruption, this could be a summer for owners to remember.

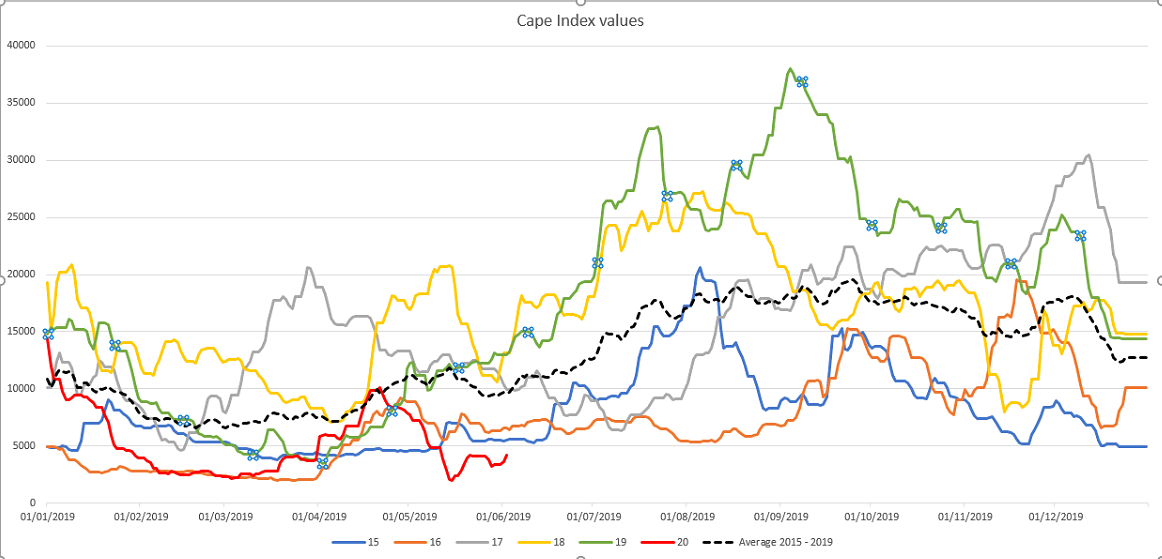

Capesize prices for the last 5 years

Seasonality would suggest that index values should now start to increase. Yes, they are 40% the value of the 5-year average, but the Capesize market is arguably one of the most volatile futures contracts on the planet. A low base does not mean that the index won’t bloom, it just tells owners that the index needs to play catch up.

Will we hit the heady heights of 2019 (Green line on chart), who knows?

Will we see the index trade above its 5 year mean value in the coming months? Probably.

Vale reaffirmed it intends to achieve export targets. Chinese PMI is expanding, and Iron ore futures are following the same pattern as 2019, but this time they are not getting carried away.

Why? Because they think supply is coming Brazil – perhaps enough to force the market into sunshine

(FIS)