Consensus

The consensus in the financial sector is that iron ore prices are looking overstretched. Almost daily we hear that supply will increase and demand will decrease in the second half of the year. If this is the case, then surely with over 100 million tons of inventory the upside is not limited, it is quite possibly over?

The Riddle

Vale continue to maintain their stance that production targets will be hit. Positive mental attitude at its best? Maybe. Skepticism is rife on how this is going to happen; the Math does not add up and this brings into question both the Iron Ore and Capesize curves. Should the Q4 Iron ore be higher than USD 90.00, is the Q4 Capsize too high at USD 15,000?

The Reality

The reality is something different, Vale are telling you something, the Capsize market is hearing it. Vale might not hit the 310 – 330-million-ton target, but it will not be from lack of trying. Vale are going to be busy, very busy, and this means that pullbacks in the back-end futures of the Capesize market are likely to continue to see the support it has enjoyed in recent months. Iron ore supply will increase, suggesting that the Q4 is potentially overstretched.

After the Event

There is a saying that if you put 10 Elliott Wave practitioners in a room you will get 10 different versions of where you are in the cycle, only after the event will they all agree.

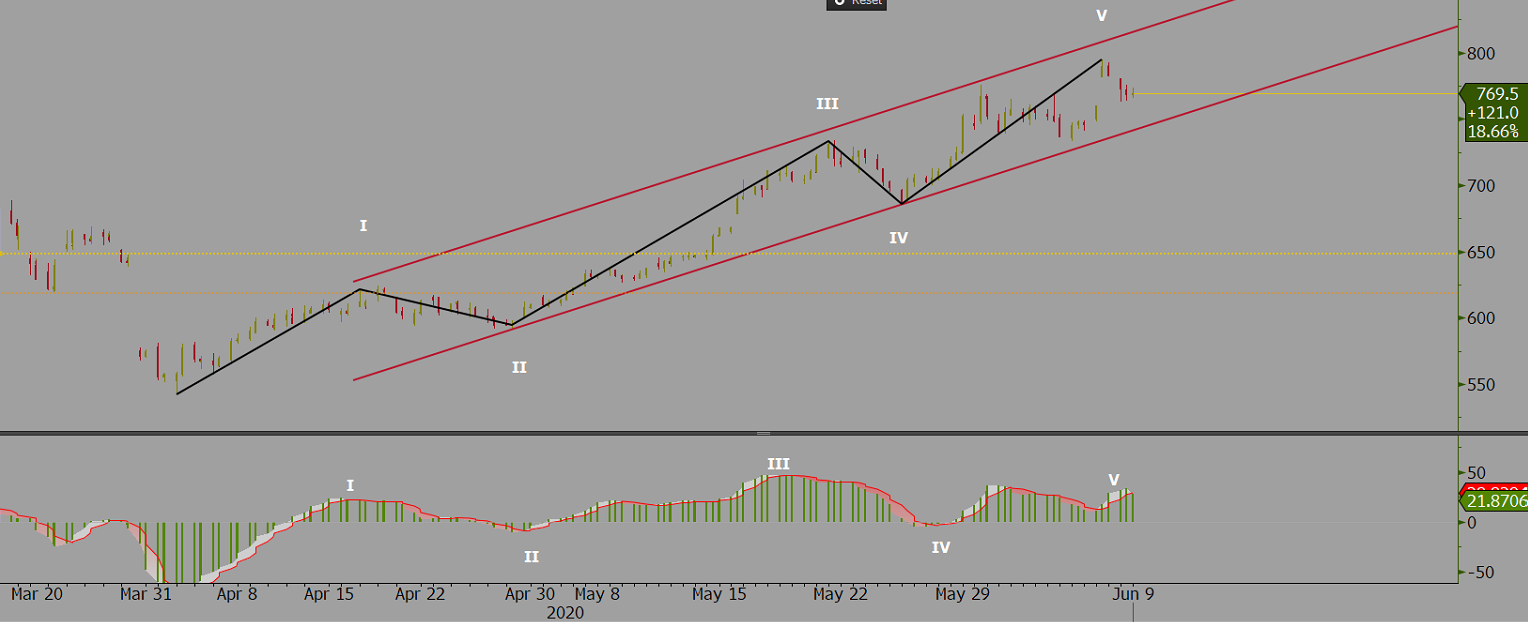

Below is the Dalian Iron or chart (source Bloomberg)

The Chart has the Elliott Wave cycle on it. When looking at the 5 waves it is hard not to agree with the financial institutions that are calling for a market correction. If the market has not topped already, then one must assume it is going to very soon.

Are we already looking back at a finished cycle?