Another strong day in the dry freight market with the Capesize index up 5.16% due to Chinese iron ore restocking and increased infrastructure spending. The index out outperformed the Baltic Dry Index which rose 3.79% after positive performances from the Panamax index at + 1.65% and Supramax Index + 0.77%.

The continued upside moves in the index has resulted in the July futures having to play a bit of catch up, with a 10.35% move to USD 25,375. The Q4 futures are back at recent highs with a 4.5% move from yesterdays close, and up 11.26% in the last 3 trading session. However, the front end futures (July) are now nearly USD 8,000 dollars above the Q4 meaning the spread looks overextend, if the Index slows the correction will come from the July futures but if the index moves much higher we could see another push in the back of the curve.

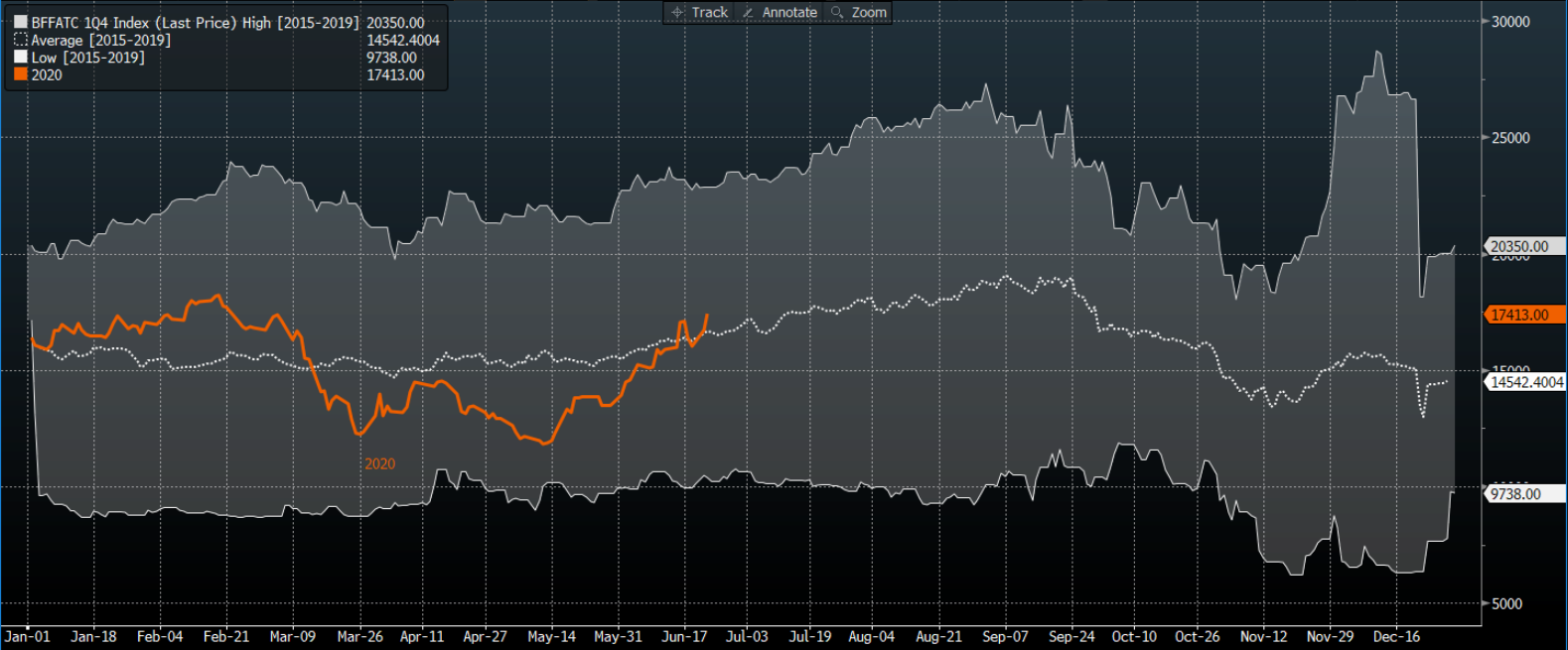

The narrowing of the spread may or may not happen over the coming days, but at USD 17,400 the Q4 futures have now moves above the 5-year average valuations for the first time in three months. More significantly is that the move is in line with bullish seasonality indicating the future could remain in a bullish trajectory until late September.

Both the seasonality and the fundamental are now in a bullish phase (this is also backed up by wave analysis on the technical) suggesting that downside moves are likely to find buying support at lower levels providing there are no further supply shocks further downstream. (FIS)