Good morning all. Brent crude was down 29 cents, or 0.7%, at $42.34 a barrel by 0335 GMT, while U.S. WTI crude futures fell 35 cents, or 0.9%, to $40.02 a barrel. The market has continued to come off recent highs after the API predicted a build of 1.7 million bbls for last week. It did, however, also predict a draw in gasoline and distillate levels. But let’s keep an eye on for later this afternoon when the EIA will confirm the actual stats. The virus outbreak continues to hit the Americas badly, with new cases of COVID-19 rose 25% in the United States in the week ended June 21 and the death toll in Latin America passed 100,000 on Tuesday, according to a Reuters analysis and tally. In the wider financial industry, according to Reuters, the world’s largest exchange-traded fund linked to oil has been hit with at least one class action lawsuit after a plunge in prices led to billions of dollars in losses and allegations that investors weren’t properly warned of the risks.

MARKETS NEWS:

* OPEC+ Laggards Fall in Line With Push for Compensatory Oil Cuts

* North Sea Oil Woes Mount as Price Rout BringsLayoffs, Shutdowns

* Oil Must Be Sustained at $60/Bbl for U.S. Output to Rise: Dudley

* Russia Sees Oil Demand Continuing Gradual Recovery: Sorokin

* Equatorial Guinea Aims to Extend Oil-Field Life With New Policy

* Culture of Inflating Oil Reserves Helped Stoke U.S. Shale Boom

* Ambani Says Reliance, Aramco Working to Complete Deal Contours

* Jump in RBOB Refining Margins Lifts Houston Gasoline

OTHER NEWS:

* Libya’s Future Hinges on a Proxy Standoff in Qaddafi’s Home Town

* Moody’s Downgrades Oman for a Second Time in 2020 as Oil Dips

* Former BP CEO Cautions Big Oil About Renewables, Praises OPEC+

* Arabs Press for Libya Ceasefire, Halt to Foreign Meddling

PHYSICAL CRUDE NEWS:

* ASIA: SOMO Sells July Basrah Light; Indian Run Rates Rise

* LATAM: Pemex Shuts Salina Cruz After Quake; Brazil Ethanol

* US/CANADA: Canada’s Oil Pipeline Problem May Be Over

* NSEA: Totsa Buys Forties, Brent; Litasco Keeps Bidding

* MED: Hellenic Petroleum Seeks CPC; Surgut Offers Urals

* WAF: Nigeria Key OSPs Flip to Premium; Egina Flows to Gain

OIL PRODUCT NEWS:

* U.S.: Rising Refining Margins Lift Houston Gasoline

* EUROPE: Flow to Americas Rises; Eni Runs Still Cut

* ASIA: Mid-East Fuel Heads to Region on Europe Glut

ECONOMIC EVENTS: (Times are London.)

* 3:30pm: EIA weekly report on U.S. oil inventories; TOPLive blog begins 3:20pm

* Genscape weekly ARA crude inventory report

ANALYST COLUMNS:

* Storage Risk Gives Pause to Hopes for Crude in Driving Season

* American Gasoline Demand Has Rebounded Almost 80%, IHS Says

OTHER FINANCIAL MARKETS:

* Stocks Mixed in Light Volume, Dollar Extends Drop: Markets Wrap

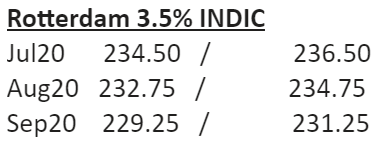

Rotterdam 3.5% INDIC

Jul20 234.50 / 236.50

Aug20 232.75 / 234.75

Sep20 229.25 / 231.25

Oct20 226.75 / 228.75

Nov20 226.00 / 228.00

Dec20 227.00 / 229.00

Q3-20 232.25 / 234.25

Q4-20 226.50 / 228.50

Q1-21 229.25 / 231.25

Q2-21 232.00 / 235.00

CAL21 231.75 / 237.75

Singapore 380 INDIC

Jul20 239.00 / 241.00

Aug20 242.75 / 244.75

Sep20 244.25 / 246.25

Oct20 244.75 / 246.75

Nov20 245.25 / 247.25

Dec20 246.50 / 248.50

Q3-20 242.00 / 244.00

Q4-20 245.50 / 247.50

Q1-21 249.00 / 251.00

Q2-21 250.50 / 253.50

CAL21 251.25 / 257.25

Rott VLSFO 0.5% INDIC

Jul20 291.00 / 297.00

Aug20 295.25 / 301.25

Sep20 299.00 / 305.00

Oct20 302.25 / 308.25

Nov20 305.00 / 311.00

Dec20 307.25 / 313.25

Q3-20 295.00 / 301.00

Q4-20 304.75 / 310.75

Q1-21 312.50 / 318.50

Q2-21 318.00 / 326.00

CAL21 322.75 / 330.75

Singapore VLSFO 0.5% INDIC

Jul20 307.00 / 313.00

Aug20 314.25 / 320.25

Sep20 319.75 / 325.75

Oct20 324.50 / 330.50

Nov20 328.50 / 334.50

Dec20 331.50 / 337.50

Q3-20 313.50 / 319.50

Q4-20 328.00 / 334.00

Q1-21 337.75 / 343.75

Q2-21 344.25 / 352.25

CAL21 346.25 / 354.25

Sing 10ppm GO INDIC

Jul20 48.38 / 48.52

Aug20 48.01 / 48.21

Sep20 48.30 / 48.50

Oct20 48.69 / 48.89

Nov20 49.06 / 49.26

Dec20 49.41 / 49.61

Q3-20 48.15 / 48.45

Q4-20 49.00 / 49.30

Q1-21 50.21 / 50.51

Q2-21 51.19 / 51.49

CAL21 51.50 / 51.90

ICE Gasoil 10ppm INDIC

Jul20 361.92 / 363.92

Aug20 366.51 / 368.51

Sep20 370.71 / 372.71

Oct20 374.08 / 376.08

Nov20 376.49 / 378.49

Dec20 379.21 / 381.21

Q3-20 366.40 / 368.40

Q4-20 376.59 / 378.59

Q1-21 384.60 / 386.60

Q2-21 394.16 / 396.16

CAL21 398.27 / 400.27

Rott Hi5 Sing Hi5

Jul20 58 70

Aug20 64 73

Sep20 72 77

Oct20 77 82

Nov20 81 85

Dec20 82 87

Q3-20 65 74

Q4-20 80 85

Q1-21 85 91

Q2-21 88 96

CAL21 92 96

UK number: +44 (0)207 090 1134

Shanghai number: +86 (0)21 63012568

|

Luke Longhurst

Ricky Forman

|

Chris Hudson

Jessie Deng |