Good morning and happy Friday. Firstly a massive congratulations to the reds for winning their first title for 30 years!

Oil prices rose in early trade on Friday, extending gains from the previous day on optimism about recovering fuel demand worldwide, despite surges in coronavirus infections in some U.S. states and indications of a revival in U.S. crude production. WTI futures gained US15 cents, or 0.4%, to $38.87 at 0009 GMT but were on track for a slight drop for the week. Brent futures rose 22 cents, or 0.5%, to $41.27, but were also heading towards a decline for the week. Analysts said satellite data showing strong pick-ups in traffic in China, Europe and across the United States pointed to a recovery in fuel demand. On the supply side, Russia’s exports of its flagship Urals are set to plunge next month, underscoring the nation’s commitment to helping OPEC and allied producers to avert a global glut.

Points from Reuters

MARKETS NEWS:

* Floating Oil Hoard Off Singapore Sheds Light on Asian Recovery

* Revival of Libya’s War-Torn Oil Industry to Be Slow and Costly

* Venezuela Oil Crisis Deepens With India Refiners Halting Imports

* Canadian Heavy Oil Prices Weaken as Enbridge Line 5 Ordered Shut

* U.S. Flagged Tanker Leaves Alaska Signaling China Destination

* Platts to Begin New U.S. Crude Benchmark for Gulf Coast

* Germany’s Crude Oil Imports in April Dropped to a 19-Month Low

* Angola’s Sonangol Sells August-Loading Kissanje Crude Cargo

* Nigeria to Ship 31K B/D of Okono Crude in August, Program Shows

* Petrobras Starts Oil and Gas Output in Atapu Pre-salt

* Colombia Oil Output Fell to the Lowest Since 2009

* Singapore Weekly Fuel Stockpiles for June 24 Fell 0.6% W/w

* Gasoil Stockpiles Fall in Europe’s ARA Region: Insights Global

PIPELINE/REFINERIES NEWS:

* Venezuela’s Iranian Fuel Relief Spotlights Ailing Refineries

* Refining Group Warns Over Mexico’s Commitment to Energy Reforms

* Imperial Warns of Gasoline, Diesel Shortfalls on Line 5 Shutdown

* Enbridge to Shut Oil Pipeline in Win for Michigan Officials

* GENSCAPE REFOUT RECAP: El Paso, Nixon, Vohburg, Fawley

OTHER NEWS:

* What to Watch in Commodities: Winners and Losers in SecondHalf

* Who Wants U.S. Oil Futures These Days? Fewer and Fewer People

* Shale Company Sable Permian Files for Bankruptcy in Texas

* Billionaire Hamm Adds $57 Million of Faith In Shale Driller

* A $70 Billion Money Manager Wants Oil in His ESG Strategy

* New Dubai-Based Oil-Trader Targets First Deals in September

PHYSICAL CRUDE WRAPS:

* ASIA: ATC Sells Prompt Murban, Agbami; India’s Run Rates

* LATAM: Venezuela’s Ailing Refineries; Colombia Output

* US/CANADA: Enbridge Told to Shut Pipeline, Prices Weaken

* NSEA: Totsa Bids Ekofisk Higher; VLCC Loading Forties

* MED: Hellenic Petroleum Buys CPC; Saharan OSP Raised

* WAF: Sonangol Sells Kissanje; Nigeria Okono August Exports

OIL PRODUCT WRAPS:

* U.S.: Enbridge Ordered to Shut NGLs-Crude Line 5

* EUROPE: Tupras Bids Diesel in Tender; Mideast Flows

* ASIA: Gasoline Margins; India’s Trailing Oil Demand

ECONOMIC DATA/EVENTS: (Times are London. )

* 6:00pm Baker Hughes weekly U.S. rig count

* 6:30pm ICE Futures Europe weekly commitments of traders report

* 8:30pm CFTC weekly commitments of traders report

* Shanghai exchange’s weekly commodities inventory

** See OIL WEEKLY AGENDA for next week’s events

ANALYST VIEWS/COLUMNS:

* New Cases in Key States Threaten Oil Price Recovery: StanChart

OTHER FINANCIAL MARKETS:

* Asian Stocks Rise After Late Wall Street Gains: Markets Wrap

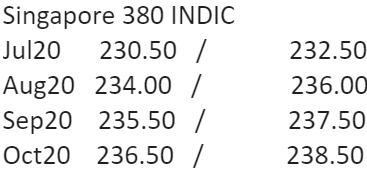

Singapore 380 INDIC

Jul20 230.50 / 232.50

Aug20 234.00 / 236.00

Sep20 235.50 / 237.50

Oct20 236.50 / 238.50

Nov20 237.25 / 239.25

Dec20 238.75 / 240.75

Q3-20 233.25 / 235.25

Q4-20 237.50 / 239.50

Q1-21 241.25 / 243.25

Q2-21 244.50 / 247.50

CAL21 248.75 / 254.75

Rotterdam 3.5% INDIC

Jul20 222.50 / 224.50

Aug20 221.75 / 223.75

Sep20 219.00 / 221.00

Oct20 216.75 / 218.75

Nov20 216.75 / 218.75

Dec20 218.25 / 220.25

Q3-20 221.00 / 223.00

Q4-20 217.25 / 219.25

Q1-21 222.00 / 224.00

Q2-21 225.50 / 228.50

CAL21 225.00 / 231.00

Singapore VLSFO 0.5% INDIC

Jul20 294.25 / 300.25

Aug20 302.00 / 308.00

Sep20 308.25 / 314.25

Oct20 313.75 / 319.75

Nov20 318.25 / 324.25

Dec20 322.00 / 328.00

Q3-20 301.50 / 307.50

Q4-20 318.00 / 324.00

Q1-21 328.50 / 334.50

Q2-21 335.50 / 343.50

CAL21 344.75 / 352.75

Rott VLSFO 0.5% INDIC

Jul20 279.00 / 285.00

Aug20 283.75 / 289.75

Sep20 287.75 / 293.75

Oct20 291.50 / 297.50

Nov20 294.50 / 300.50

Dec20 297.25 / 303.25

Q3-20 283.50 / 289.50

Q4-20 294.50 / 300.50

Q1-21 303.50 / 309.50

Q2-21 309.25 / 317.25

CAL21 318.00 / 326.00

Sing 10ppm GO INDIC

Jul20 47.22 / 47.36

Aug20 46.81 / 47.01

Sep20 47.08 / 47.28

Oct20 47.46 / 47.66

Nov20 47.80 / 48.00

Dec20 48.15 / 48.35

Q3-20 47.00 / 47.30

Q4-20 47.76 / 48.06

Q1-21 49.01 / 49.31

Q2-21 50.23 / 50.53

CAL21 50.83 / 51.23

ICE Gasoil 10ppm INDIC

Jul20 351.33 / 353.33

Aug20 356.09 / 358.09

Sep20 360.58 / 362.58

Oct20 364.00 / 366.00

Nov20 366.45 / 368.45

Dec20 369.37 / 371.37

Q3-20 356.00 / 358.00

Q4-20 366.61 / 368.61

Q1-21 378.17 / 380.17

Q2-21 385.53 / 387.53

CAL21 391.24 / 393.24

Rott Hi5 Sing Hi5

Jul20 59 66

Aug20 64 70

Sep20 71 75

Oct20 77 79

Nov20 80 83

Dec20 81 85

Q3-20 65 70

Q4-20 79 83

Q1-21 84 89

Q2-21 86 94

CAL21 94 97

UK number: +44 (0)207 090 1134

Shanghai number: +86 (0)21 63012568

|

Luke Longhurst

Ricky Forman

|

Chris Hudson

Jessie Deng |