Australian medium grade fines kept its high popularity status among Chinese buyers for the week ended on 26 Jun 2020.

The short trading saw a total of 2.4 million mt iron ore exchanged hands, up 21.26% on-week from previous week volumes at 1.9 million mt.

New platform for iron ore trading

The uptick of traded iron ores was due to the launch of new trading platform, HBIS International Ore Supermarket on Monday.

The new platform differentiated from existing trading platforms of COREX and globalORE by making the bids and offers open to all companies registered and approved by HBIS.

Moreover, HBIS will back all the trades concluded on Ore Supermarket, thus if a party default from a trade, HBIS will step in and guarantee the trade settlement with the counter-party.

More preferences for mainstream Australian fines

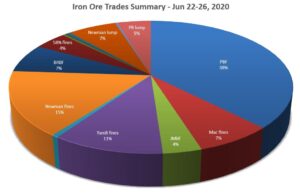

Among the trades, Pilbara Blend fines (PBF) continued to be the mainstay accounting nearly 38% of the trades, followed by Newman fines, Yandi fines and Mac fines.

Brazilian Blend fines (BRBF) only accounted around 7% of the total traded volume, as Chinese mills reduce its demand for high grade ores like BRBF due to thin steel margins.

For blast furnace mix, more end-users prefer to use mainstream Australian fines like Mac fines, Newman fines and PBF, which accounted around 20-25% of blending mix, while BRBF usage only accounted no more than 10% at best.

China’s pig iron and crude steel output to rise in 2020

Platts expects China’s pig iron and crude steel production to increase by 1.7% and 2% respectively on yearly basis for 2020.

For pig iron production, Platts estimated China’s output to reach around 860 million mt in 2020, while crude steel production is expected to break the 1 billion mt mark for the first time to around 1,016 million mt in 2020.

The high estimate was due to rising China’s infrastructure investment that increased by about 8% year on year in May. At this momentum, the yearly infrastructure investment growth rate may reach around 10% for 2020.