Good morning all. Brent crude futures were down 35 cents, or 0.8%, at $42.79 a barrel as of 0633 GMT, and U.S. WTI crude futures fell 35 cents, or 0.9%, to $40.30 a barrel. Both benchmarks rose more than 2% yesterday, buoyed by stronger-than-expected U.S. jobs data and a fall in U.S. crude inventories. For the week, Brent is up 4.3% and WTI is up 4.7%. With early Independence Day holiday celebrations already in action, things are expected to be quiet today as many have taken a long weekend holiday. As lockdowns in the US are eased, data from the Department of Labour non-farm payrolls added 4.8 million jobs in June, exceeding market expectations of a 3.2 million gain, and bringing the nationwide unemployment rate down to 11.1% from 13.3%. However, 55,000 new COVID-19 cases in the US are dampening market sentiment as the country heads toward the Fourth of July weekend, traditionally one of the busiest driving periods of the year. Surges in infections in Australia and Japan among others raised fears about the potential declaration of another emergency, reversing the currently prevailing confidence that easing restrictions on travel and business would boost demand for crude oil. On the supply side, OPEC+ record production cuts of 9.7 million b/d is set to expire at the end of July, raising debates on potential changes of action from the next month. In the US oil production continued as working rigs fell for a 16th week to the least since 2009, according to Baker Hughes data released Thursday.

MARKETS NEWS:

* Oil-Rig Slump Deepens in U.S. to Least Since Shale’s Infancy

* Russia Says No Decision Yet to Extend Record OPEC+ Cuts

* OPEC Middle East Oil Flows Shrink Further as Output Cuts Deepen

* U.S. Seeks to Seize Iran Fuel on Tankers Headed to Venezuela

* Gasoline Refining Margins Rise in U.S. Ahead of July 4 Holiday

* Fourth of July Weekend Gasoline Demand Seen Down 20% Y/Y

* Libya’s Agoco to Start Ramping Up Oil Output at Messla Field

OTHER NEWS:

* Exxon’s Historic Losses Multiply on Virus-Driven Crude Slump

* Rebels Try to Avert Oil Spill From Tanker Trapped by Yemen War

* Argentina Oil Giant Seeks $1 Billion Debt Swap to Save Cash

PHYSICAL CRUDE NEWS:

* ASIA: Indian Fuel Sales Climb in June; OPEC Slashes Output

* LATAM: Brazil Crude Exports Fall; Iranian Gasoline

* US/CANADA: Oil-Rig Slump Deepens in U.S., Least Since 2009

* NSEA: Vitol Offers Forties; June Flows Fell to 8-Mon. Low

* MED: Shell Buys Urals at Lower Price; CPC Final Program

* WAF: S. Africa Refinery Blast; Okwori Attack; Rabi Tender

OIL PRODUCT NEWS:

* U.S.: Trainer Refinery Dips Back Into Jet Market

* EUROPE: Flow to West Africa Rebounds; Milazzo FCC

* ASIA: Singapore Stockpiles at Lowest Since April

ECONOMIC EVENTS: (Times are London)

* U.S Independence Day Holiday

* 6:30pm: ICE Futures Europe weekly commitments of traders report

* NOTE: CFTC CoT Report delayed to next week

* 8:00pm: Venezuela Crude Oil Basket CNY, period Jul 3

ANALYST COLUMNS:

* FGE Sees Oil Prices Dropping to ~$35/Bbl Before Recovering in 4Q

* Limited Upside to Gasoline Cracks If Refiners Boost Runs: BofA

* Chinese Crude Inventories Swell to Record: Ursa Space Systems

OTHER FINANCIAL MARKETS:

* Asian Stocks Climb in Thin Volume After U.S. Gains: Markets Wrap

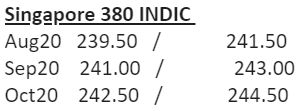

Singapore 380 INDIC

Aug20 239.50 / 241.50

Sep20 241.00 / 243.00

Oct20 242.50 / 244.50

Nov20 243.75 / 245.75

Dec20 245.50 / 247.50

Jan21 247.25 / 249.25

Q4-20 244.00 / 246.00

Q1-21 248.25 / 250.25

Q2-21 250.25 / 252.25

Q3-21 251.50 / 254.50

CAL21 249.25 / 255.25

Rotterdam 3.5% INDIC

Aug20 229.25 / 231.25

Sep20 227.25 / 229.25

Oct20 225.25 / 227.25

Nov20 225.00 / 227.00

Dec20 225.75 / 227.75

Jan21 227.75 / 229.75

Q4-20 225.50 / 227.50

Q1-21 229.00 / 231.00

Q2-21 231.75 / 233.75

Q3-21 233.00 / 236.00

CAL21 230.50 / 236.50

Singapore VLSFO 0.5% INDIC

Aug20 315.25 / 320.25

Sep20 319.25 / 324.25

Oct20 323.25 / 328.25

Nov20 327.00 / 332.00

Dec20 330.75 / 335.75

Jan21 334.25 / 339.25

Q4-20 327.00 / 332.00

Q1-21 337.00 / 342.00

Q2-21 344.00 / 350.00

Q3-21 350.50 / 356.50

CAL21 346.75 / 352.75

Rott VLSFO 0.5% INDIC

Aug20 301.75 / 306.75

Sep20 305.00 / 310.00

Oct20 307.50 / 312.50

Nov20 309.75 / 314.75

Dec20 312.00 / 317.00

Jan21 314.25 / 319.25

Q4-20 309.75 / 314.75

Q1-21 316.50 / 321.50

Q2-21 321.75 / 327.75

Q3-21 326.50 / 332.50

CAL21 323.75 / 329.75

Sing 10ppm GO INDIC

Aug20 48.88 / 49.02

Sep20 48.75 / 48.95

Oct20 48.94 / 49.14

Nov20 49.18 / 49.38

Dec20 49.40 / 49.60

Jan21 49.72 / 49.92

Q4-20 49.15 / 49.35

Q1-21 50.07 / 50.27

Q2-21 51.08 / 51.28

Q3-21 52.11 / 52.31

CAL21 51.37 / 51.77

ICE Gasoil 10ppm INDIC

Aug20 368.17 / 370.17

Sep20 371.65 / 373.65

Oct20 373.92 / 375.92

Nov20 375.15 / 377.15

Dec20 377.38 / 379.38

Jan21 380.03 / 382.03

Q4-20 375.50 / 377.50

Q1-21 382.05 / 384.05

Q2-21 388.87 / 390.87

Q3-21 393.03 / 395.03

CAL21 390.68 / 392.68