Good morning all. Brent crude futures declined by 19 cents, or 0.4%, to $42.91, after hitting an intraday high of $43.19. U.S. WTI crude futures fell 17 cents, or 0.4%, to $40.46 a barrel at 0340 GMT, after earlier rising to as high as $40.79. In the US, some 16 states are reporting record increases in new virus cases. In California, hospitalisations have risen 50% over the past two weeks, with infections recorded infections rising more than This is limiting what would normally be US driving season demand, with gasoline demand down considerably. Analysts are expected the API and EIA to show a build in gasoline stocks of 100,00 bbls in their data this week. This news is bringing into focus the complicated move back to normality of a large chunk of the world economy without which there can be no return to previous levels of demand. On the supply side, Saudi Aramco announced a hike in official selling price differentials for its August crude oil exports to Asia by $1/b for all grades yesterday.

MARKETS NEWS:

* Saudis Raise Oil Pricing to U.S., Asia as Demand Recovers

* In The Physcial Oil Market, Sour Barrels Trade at Sweet Prices

* Venezuela’s Fuel Shortage Returns After Iranian Cargoes Dry Up

* Some Sweet U.S. Crudes Rise After News DAPL Pipe to Shut

* Main North Sea Crude Loadings to Fall to 1.94M B/D in August

* Eni Cuts Long-Term Brent Price Outlook to $60/Bbl From $70/Bbl

* CME Cuts August WTI Crude Futures Margin by $1,000 to $6,800

* Gasoline Demand Across U.S. Holiday Weekend Down 22%: GasBuddy

* U.S. Gasoline Imports From Europe Jump to 12-Week High: Customs

* Brazil Fuel Demand Rises, Still Short of Pre-Pandemic Levels

OTHER NEWS:

* Samsung’s $626 Million Oil ETF Alters Index After Rally Miss

* Mexico’s Debt-Laden Oil Giant Is Asking Contractors for IOUs

* Shale Patch Gets More Than $2.4 Billion in U.S. Virus Aid

* Watchdog Asks Nornickel to Pay $2 Billion for Arctic Spill

PHYSICAL CRUDE NEWS:

* ASIA: Saudis Raise OSPs to Asia for August; Refinery Pain

* LATAM: Lula-Producing FPSOs Up; Vista Offers Medanito

* US/CANADA: Dakota Access Oil Line to Be Shut by Court

* NSEA: Loadings to Fall in August; Mercuria Buys 2 Cargoes

* MED: Shell Bids Urals Lower; Aramco Raises August OSPs

* WAF: IOC Issues Two Tenders; Ancap Seeks Cargo for Sept.

OIL PRODUCT NEWS:

* EUROPE: Flow to U.S. Surges; Repsol Cartagena CDU

* ASIA: Chinese Clean Fuel Exports Drop in June

ECONOMIC EVENTS: (Times are London.)

* 5pm: EIA publishes its monthly Short-Term Energy Outlook (STEO)

* 9.30pm: API weekly report on U.S. oil inventories

ANALYST COLUMNS:

* Oil Refining to Remain Challenging Over Next 1-2 Years: FGE

* Oil Needs to Rise $10/Bbl for ‘Material Production’ Rise: Sen

* Little to Get Excited About in Crude Oil Sans Vaccine, Therapy

OTHER FINANCIAL MARKETS:

* China Shares Climb Even as Global Rally Pauses: Markets Wrap

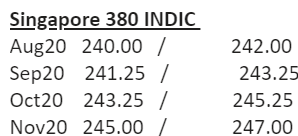

Singapore 380 INDIC

Aug20 240.00 / 242.00

Sep20 241.25 / 243.25

Oct20 243.25 / 245.25

Nov20 245.00 / 247.00

Dec20 247.00 / 249.00

Jan21 248.50 / 250.50

Q4-20 245.00 / 247.00

Q1-21 249.50 / 251.50

Q2-21 252.00 / 254.00

Q3-21 253.50 / 256.50

CAL21 250.25 / 256.25

Rotterdam 3.5% INDIC

Aug20 230.25 / 232.25

Sep20 228.50 / 230.50

Oct20 226.75 / 228.75

Nov20 226.50 / 228.50

Dec20 227.75 / 229.75

Jan21 229.50 / 231.50

Q4-20 227.00 / 229.00

Q1-21 230.75 / 232.75

Q2-21 233.75 / 235.75

Q3-21 235.00 / 238.00

CAL21 231.50 / 237.50

Singapore VLSFO 0.5% INDIC

Aug20 313.75 / 318.75

Sep20 317.75 / 322.75

Oct20 321.75 / 326.75

Nov20 325.75 / 330.75

Dec20 329.50 / 334.50

Jan21 332.75 / 337.75

Q4-20 325.75 / 330.75

Q1-21 335.50 / 340.50

Q2-21 342.00 / 348.00

Q3-21 348.50 / 354.50

CAL21 345.00 / 351.00

Rott VLSFO 0.5% INDIC

Aug20 302.75 / 307.75

Sep20 306.50 / 311.50

Oct20 309.00 / 314.00

Nov20 311.25 / 316.25

Dec20 313.50 / 318.50

Jan21 316.25 / 321.25

Q4-20 311.25 / 316.25

Q1-21 318.50 / 323.50

Q2-21 324.50 / 330.50

Q3-21 329.50 / 335.50

CAL21 326.50 / 332.50

Sing 10ppm GO INDIC

Aug20 48.96 / 49.10

Sep20 48.90 / 49.10

Oct20 49.11 / 49.31

Nov20 49.34 / 49.54

Dec20 49.59 / 49.79

Jan21 49.94 / 50.14

Q4-20 49.35 / 49.55

Q1-21 50.32 / 50.52

Q2-21 51.32 / 51.52

Q3-21 52.32 / 52.52

CAL21 51.59 / 51.99

ICE Gasoil 10ppm INDIC

Aug20 370.31 / 372.31

Sep20 373.47 / 375.47

Oct20 375.67 / 377.67

Nov20 376.98 / 378.98

Dec20 379.34 / 381.34

Jan21 381.95 / 383.95

Q4-20 377.35 / 379.35

Q1-21 383.88 / 385.88

Q2-21 392.03 / 394.03

Q3-21 401.11 / 403.11

CAL21 395.31 / 397.31

Rott Hi5 Sing Hi5

Aug20 72 74

Sep20 78 77

Oct20 82 79

Nov20 85 81

Dec20 86 83

Jan21 87 85

Q4-20 84 81

Q1-21 88 86

Q2-21 91 91

Q3-21 94 95

CAL21 92 95