A total of 1.38 million mt of iron ores was traded for the week ended Oct 2, down almost 27% week-on-week as compared to the 1.89 million mt recorded last week.

The decline in trading volumes was due to the shorter trading week as the Chinese participants were absence in the market for the Golden week holidays.

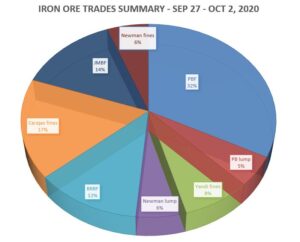

Pilbara Blend fines (PBF) then accounted almost one third of the market shares at 32.61%, then followed by Carajas fines at 16.67%, and then Jimblebar fines at 13.77%, over the Sep 28 – Oct 2 period.

More mills seeking for Brazilian ores

There were increasing number of trade participants seeking for Brazilian ores such as Carajas fines and Brazilian Blend fines.

As some trade participants found that the prices of Brazilian ores did not rise as high as the medium grade ores in the recent rally.

Besides, market participants also expect strong steel demand after the Chinese Golden Week holidays, especially for Brazilian iron ore with low alumina contents to prepare for the upcoming winter sintering cut season.

Not much disruption for Brazilian supply

During the week, there was some supply concerns for Brazilian iron ores, due to Vale’s suspension for concentrate activities at its Viga mine.

However, some market participants deemed that the loss of 11,000 mt/day to be rather insignificant and believed that further price movement will be determined by the downstream steel demand after the Golden week holidays.

Besides, Brazilian iron ore shipments typically peaked during the second half of the year, and this found supports from China’s General Administration of Customs.

According to the custom data, China imported 23.5 million mt of Brazilian iron ores in August, up 15% month-on-month, despite an overall five-month import drop at 100.36 million mt, down 11% on monthly basis.