Is the market taking a rest, or is it bullish? This is the question that traders need to ask when looking at the iron ore. Four bearish days have been capped by two bullish days (one bullish and a push into the night session) with the futures up 1.6% at USD 116.76, this would suggest sentiment is improving. Headline rhetoric is still bearish and talking about supply, margins are again lower, yet price is up. Profit taking into the weekend? Potentially, or is it market speculation on the back of further economic expansion?

For iron ore we have some conflicting variables ahead of us, economic expansion versus record output of ore and falling margins. For price there is a Doji star, followed by a bull candle, implying the market is potentially looking for a short-term sentiment spike into the next data release. Buying the rumour selling the fact could be in play at this point. For higher prices next week prices next week, the pivot point reversal pattern that is in play would be a good start.

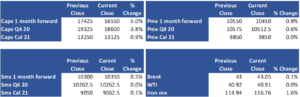

The Capesize sector literally been run over this week. The November futures are down another 5% today as miners continue to let the market cool down from a yearly high that was set just two weeks ago. That’s 15% for the week, it started with fight, but in reality, when the sellers stepped back, and the futures climbed just USD 500 in two days on low volume it was obvious that buyside value was not going to be achieved. If you wanted to be short, then you have had to cross the spread.

Very quiet end to the week in terms of volume for the Panamax futures. Further declines have been priced in so we are now seeing a momentum slowdown to see if the index will catch up. The November futures were down less than 1%, Friday apathy, or are we readying for a countertrend move? Too early to tell yet, but the key focus is on the word countertrend, at this point there is no reason to think this bear phase is over.

The Supramax closed the week with low volume and unchanged on the day. In this instance it really does look like Friday apathy here, with nothing of note to talk about

If Thursday was EIA saviour’s day, then we should have paid a little more attention to the closing candle, as it was in fact a hanging man. Although this candle closes close to its high, it is a warning that sellers have entered the market and are willing try and push it lower. Technically bullish we maybe, but right now there are some questions being asked of the Brent futures. Fortune has been in its favour with the EIA figures keeping it propped up, but will support hold, and if so for how long?

It is a wrap

Have a good weekend