A total of 1.02 million mt of iron ores was traded for the week ended Oct 30, down almost 27% week-on-week as compared to the 1.39 million mt recorded last week.

The declining volumes was in line with market expectation of the upcoming winter production cut with strict environmental regulations being implemented.

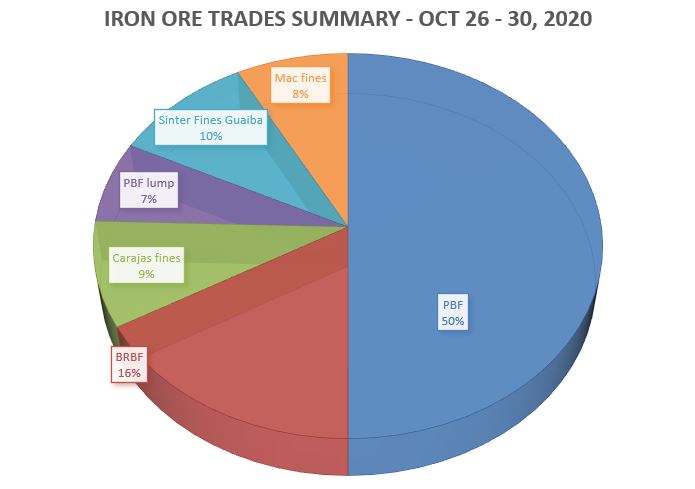

Pilbara Blend fines (PBF) once again accounted most of the market shares at 50%, then followed by BRBF at 16%, followed by Sinter Fines Guaiba at 10%, over the Oct 26 – 30 period.

More low grade-high grade combinations for blast furnace mix

Due to thin steel margins, more mills adopted low grade-high grade combination as feedstocks for blast furnaces, which explained the higher procurement of Brazilian fines this week.

Market participants were more interested in the December-arrival cargoes as compared to November-arrival cargoes.

Buyers were heard to be interested in low grade fines for December laycan such as Special Fines and Fortescue Blend fines, while some smaller mills were seeking for low grade Indian fines.

Stricter environmental curbs expected

Chinese market participants expected stricter environmental controls and output cut in the winter season that supported steel margins.

Thus, the demand for pellets and lumps were supported in near term, though there was much availability of lump supply in the market.

Some mills also seek more of Jimblebar fines, due to the higher quality of Fe content in recent cargo arrival.