A total of 1.15 million mt of iron ores was traded for the week ended Nov 6, up 12.75% week-on-week as compared to the 1.02 million mt recorded last week.

There were some catch-up operations among the Chinese construction firms right before the winter season, which resulted in more procurement.

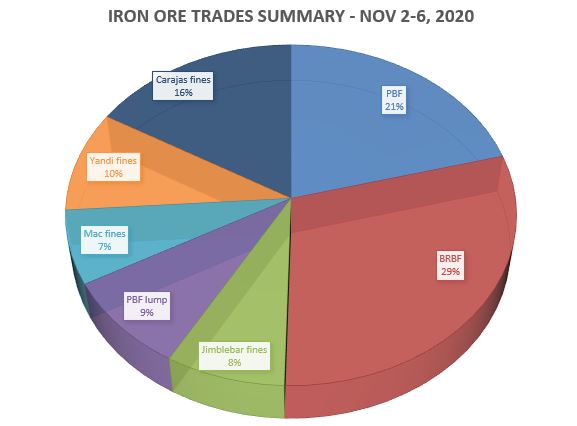

BRBF toppled PBF as the most popular iron ore products transacted for the week at 29%, then seconded by PBF at 21%, and finally Carajas fines came in third at 16%.

More demand for discounted high-grade fines

There were more purchases for Brazilian fines this week due to increasing utilization of the high grade and low-grade combination in the blast furnace mix.

According to trade sources, the recent improved steel margins were not enough to cover the usage of high-grade fines like Carajas fines. Instead, more end-users prefer to seek other discounted high-grade ores to keep production cost low.

Meanwhile, some trade participants expect further corrections for PBF, due to more offerings of the product by Rio Tinto in the market recently.

Pellet demand to rise amid supply tightness

Pellet demand continued to rise due to supply tightness among port stocks, while end-users procured more pellets to prepare for the sintering cut in Tangshan over the November to March 2021 period.

Outside of China, the supply of pellet did not fare better as well, as trade sources stated that that there was limited supply of Indian pellets due to the rising coronavirus cases in the country.

Hence, buyers were heard to be seeking pellets for US and Chile sources ahead of the winter sintering cut season.