A total of 925,000 mt of iron ores was traded for the week ended Dec 4, down 32.5% week-on-week, as compared to 1.37 million mt of iron ore traded last week.

Apparently, most of the end-users had risen their restocking activities over the past week and the lower transaction volume implied their concerns over lesser construction activities during winter season.

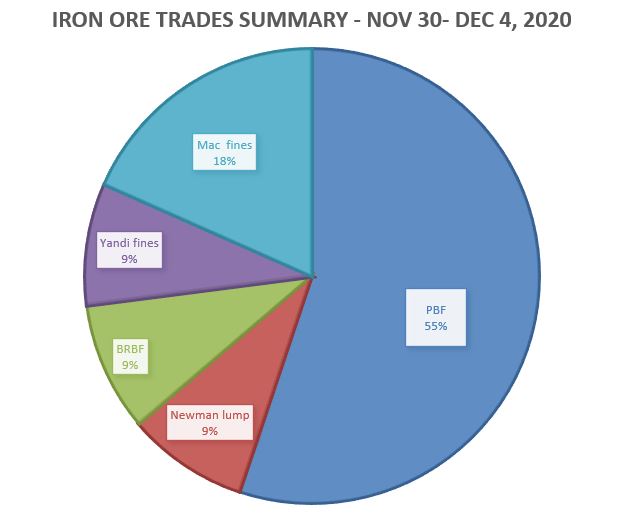

PBF accounted over half of the transacted iron ore products for the week at 55%, then followed by Mac fines at 18%, and finally BRBF came in third at 9.19%.

Good economic indicators and steel margins

This week saw the benchmark iron ore prices to hover higher than the $130/mt mark and seemed to head toward the $140/mt level soon, given the bullish market momentum.

The rally was driven by good steel margins and the good economic indicators from China like the Caixin/IHS Markit PMI, which rose to almost 10-year high in November at 54.9 readings, as the country’s manufacturing sector recovered back to pre-COVID 19 level.

This market positivity started the week on good run with steel margins heard to be high over RMB 300/mt in northern China for hot-rolled coil (HRC), while the cold-rolled coil margins reached over RMB 400/mt level.

More speculative buying ahead?

Due to the high margins, buyers were seeking for medium grade products on speculative demand, even though the high steel margins normally benefit the higher grade products.

Most of the buying interests focused on mainstream medium grade Australian fines like PBF for January laycan, as end-users began restocking activities ahead of the Chinese New Year holidays next year in early February.

Besides PBF, the buyers were also interested in MAC fines and Jimblebar fines for their cost-efficiency. Meanwhile, some end-users were seeking BRBF in at portside as well, due to the narrowing RMB spread between BRBF and PBF.