A total of 180,000 mt of iron ores was traded for the week ended Dec 11, down almost 80.54% week-on-week, as compared to 925,000 mt of iron ore traded last week.

The week also seen iron ore prices soaring to record-high level toward $160/mt in the matter of days, which led some market experts to deem the rally as speculative, while others pointed to the good steel demand and margins.

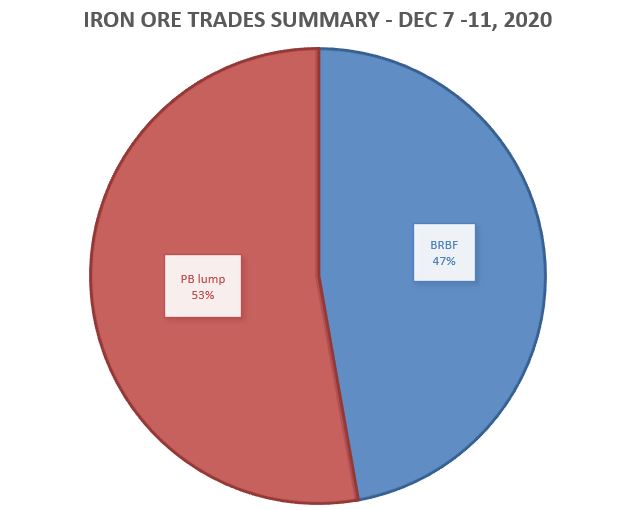

With seaborne iron ore prices at record high level, some buyers stayed at the sidelines from seaborne procurement and preferred to buy from portside stocks instead. Thus, PB lump accounted over half of the transacted iron ore products for the week at 53%, then followed by BRBF at 47%.

Renewed interests on low grade ores

There were some renewed buying interests for low grade fines like Super Special fines and Indian fines, due to more mills adopting the combination of low grade and high-grade ores in blast furnace mix.

This configuration was deemed to be more cost-efficiency than using medium grade ores, due to the recent high raw material costs that squeezed steel margins.

BRBF also remained popular among some Chinese end-users, as mills used them for blending as much as they used PBF for the blast furnace mix.

In the meantime, some traders increased their procurement for the Brazilian fines on more speculative interests, as they tried to resell cargoes to southern Chinese end-users.

Lump premium to improve slower this year

The lump premium is expected to improve by year-end, but at a slower rate compared to previous years, due to the implementation of less strict environmental sintering restriction for this winter season.

In the meantime, the lump premiums had picked up this week, due to the limited pellet supply and output restriction in Tangshan.

However, some trade participants were more bearish on lump premium in near term, stating that the lump utilization had peaked among mills and there were little upsides for further upward adjustment.