A total of 1.11 million mt of iron ores was traded for the week ended Jun 4, amid softening steel margins due to commodity price control imposed by the Chinese authority.

However, benchmark iron ore prices soon found some support after market talks of easing steel output restriction in Tangshan that spurred paper trading and lifted sentiment.

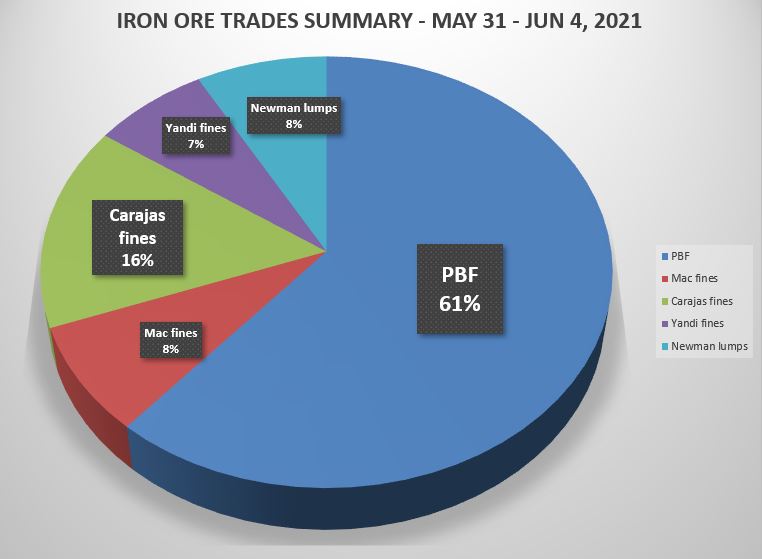

During the week, the trades volume of PBF accounted the largest market share at 61% during the week, then followed by Carajas fines at 16%, and lastly Mac fines at 8%.

Low grade fines gain market interest amid low steel margins

Most Chinese mills continued to seek medium grade fines such as PBF, though there were some interests to switch to low grade fines for cost saving.

It was heard that some mills were seeking for Yandi fines due to their low alumina and good sintering properties, while it was harder to obtain Indian fines due to long port clearance time.

According to trade sources, the clearance procedures for Indian cargoes needed arrangement of around 21-28 days with local Chinese port authorities like Caofeidian port and some Shandong ports.

Meanwhile, the long waiting time also affected Indian pellet imports as trade sources expected around 12 days of delay due to strict port clearance.

Mixed outlook for lump demand

The lump demand remained firm though there were mixed market views as Tangshan end-users were heard to reduce mainstream lump usage, opting for the cheaper non-mainstream lump, sinter or pellet instead.

On the other hand, the lump supply continued to tighten especially in the river ports and Shandong province which support price upticks.

In the meantime, Japanese mills were more active in seaborne trade, seeking for July and August lump cargoes to meet steelmaking demand.