Market Verdict on Iron Ore:

· Iron ore short-run neutral to bearish.

Macro

· China will rely on step-by-step measures to slow the appreciation of the yuan, to restrict speculators and help local exporters avoid tough measures that may impede its goal of liberalizing the yuan and enhancing its global influence. The people’s Bank of China said in a statement in response to a question from Reuters that the people’s Bank of China “will not use the exchange rate as an instrument” and has not discussed changing the exchange rate formation mechanism, which is a managed floating exchange rate system based on market supply and demand and adjusted with reference to a basket of currencies.

· General Administration of Customs: China’s exports in May increased by 27.9% year-on-year, expected to increase by 32.1% and the previous value by 32.3%. China’s imports rose 51.1% year-on-year in May, expected to grow by 53.5% and the previous value by 43.1% calculate based on dollars.

Iron Ore Key Indicators:

· Platts62 $208.35, -2.85, MTD $209.53. The premium of seaborne trade dropped from a historical high around $9.5 level to $8.75 on PBF, indicating a slight conservative sentiment, along with decreasing trading volume on seaborne and ports.

· Vale restricted iron ore operations surrounding tailing dames near the scene of a 2015 disaster, affecting 33,000 metric tonnes of daily output, some points of access to the mine were also closed with a 7,500 tonne daily impact. The affection was very limited since Vales said would work to resume activities as soon as possible. The worst case of affection only totaled 2.43 million tonnes even if this closure last for two months.

· Imports of iron ore, crude oil, soybeans and other commodities rose, while imports of natural gas increased and prices fell. In the first five months, China imported 472 million tons of iron ore, an increase of 6% y-o-y, and the average import price was 1032.8 yuan per ton, an increase of 62.7% y-o-y; Crude oil was 221 million tons, up 2.3% y-o-y. The average import price was 2809.2 yuan per ton, up 9.1% y-o-y.

SGX Iron Ore 62% Futures& Options Open Interest (Jun 4th)

· Futures 77,195,300 tonnes(Increase 904,400 tonnes)

· Options 73,347,300 tonnes(Increase 215,000 tonnes)

Steel Key Indicators

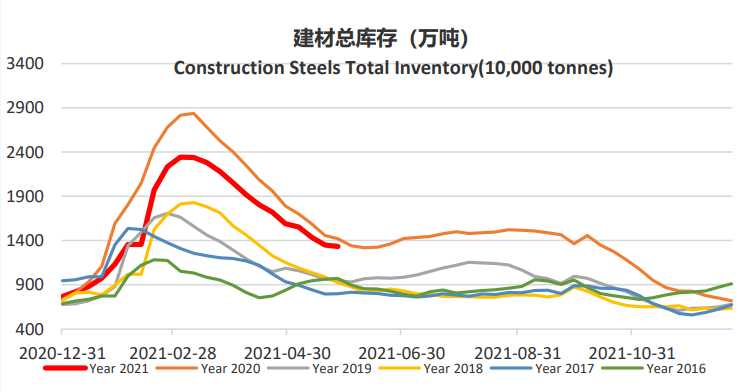

· Steelbank construction steels inventory 6.42 million tonnes, down 2.07% w-o-w. HRC inventories 2.345 million tonnes, down 0.36% w-o-w.

· Tangshan Fengrun District independent steel rolling mills restricted production from June 5th to 13th. The daily output was affected by 57,700 tons, which increased by 33,500 tons compared with June 3rd. The operating rate of 35 billet processing mills was reduced from 59.57% to about 22%.

· According to the requirements of Xuzhou government, annual crude steel output cannot exceed last year’s general direction. At the same time, according to Mysteel, other steel mills in Jiangsu province also have same requirements. From July to December 2021, the crude steel output of Jiangsu Province will be reduced by about 8 million tons, and the average daily crude steel output will be more than 40,000 tons.